Mortgage Rates Rise as International Economic Woes Continue

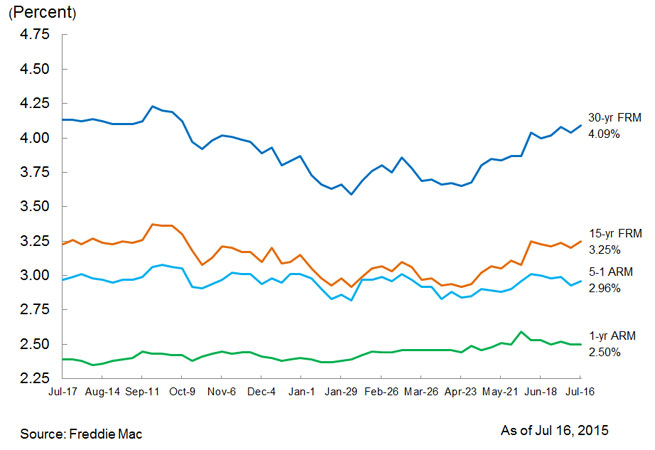

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing fixed-rate mortgages (FRMs) reversing course and moving to their highest level this year amid ongoing volatility in bond markets. The 30-year fixed-rate mortgage (FRM) averaged 4.09 percent, with an average 0.6 point for the week ending July 16, 2015, up from last week when it averaged 4.04 percent. A year ago at this time, the 30-year FRM averaged 4.13 percent. Also this week, the 15-year FRM averaged 3.25 percent with an average 0.6 point, up from last week when it averaged 3.20 percent. A year ago at this time, the 15-year FRM averaged 3.23 percent.

"The crisis in Greece continues to generate volatility in U.S. Treasury yields," said Sean Becketti, chief economist, Freddie Mac. "The tentative agreement hammered out last weekend gave investors the confidence to pull back a bit from Treasuries. Rates rose about 16 basis points on the 10-year Treasury from last week. As a result, the average rate on a 30-year fixed-rate mortgage rose 5 basis points this week to 4.09 percent, the highest level since October of last year."

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.96 percent this week with an average 0.5 point, up from last week when it averaged 2.93 percent. A year ago, the five-year ARM averaged 2.97 percent. The one-year Treasury-indexed ARM averaged 2.50 percent this week with an average 0.3 point, unchanged from last week. At this time last year, the one-year ARM averaged 2.39 percent.