Treasury Yields Drive Mortgage Rates Lower

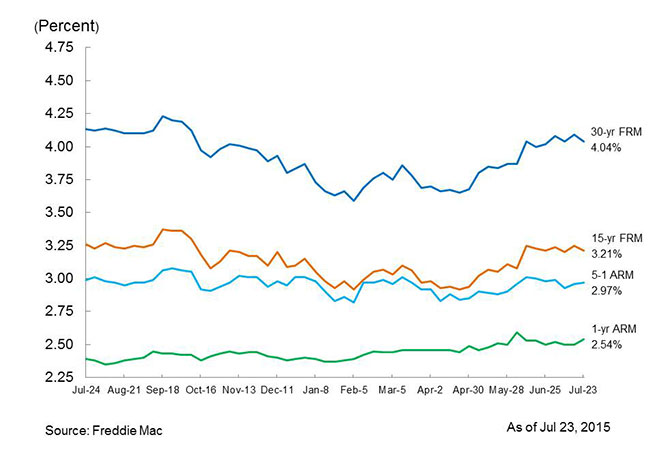

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing fixed-rate mortgages (FRMs) reversing course once again and moving lower amid mixed economic and housing data. The 30-year FRM averaged 4.04 percent with an average 0.6 point for the week ending July 23, 2015, down from last week when it averaged 4.09 percent. A year ago at this time, the 30-year FRM averaged 4.13 percent. The 15-year FRM this week averaged 3.21 percent with an average 0.6 point, down from last week when it averaged 3.25 percent. A year ago at this time, the 15-year FRM averaged 3.26 percent.

"U.S. Treasury yields dropped following announcements that many blue chip companies' earnings failed to meet expectations," said Sean Becketti, chief economist, Freddie Mac. "This drove the 30-year fixed rate mortgage down five basis points to 4.04 percent this week. Housing continues to be the bright spot in the economic recovery. Existing home sales beat market expectations coming in at a seasonally adjusted annual rate of 5.49 million homes. This is up 9.6 percent from a year ago and the fastest pace since 2007. Also, housing starts jumped 9.8 percent responding to strong demand in the multifamily market."

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.97 percent this week with an average 0.5 point, up from last week when it averaged 2.96 percent. A year ago, the five-year ARM averaged 2.99 percent. Also this week, the one-year Treasury-indexed ARM averaged 2.54 percent this week with an average 0.3 point, up from last week when it averaged 2.50 percent. At this time last year, the one-year ARM averaged 2.39 percent.