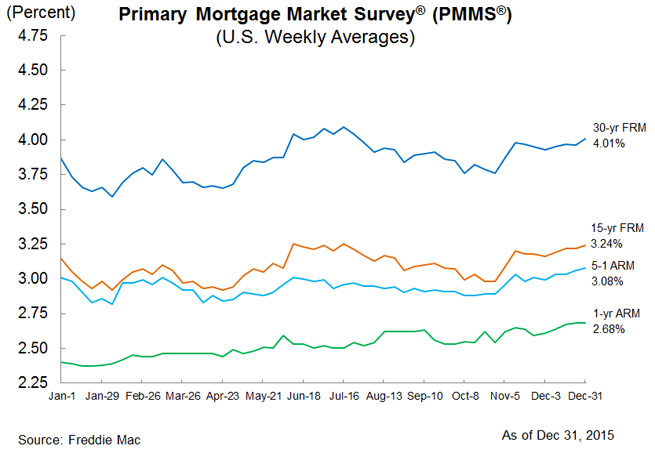

Mortgage Rates Close 2015 Above Four Percent

As 2015 comes to a close, fixed-rate mortgages (FRMs) managed to end the year above the often-elusive four percent mark.

According to Freddie Mac’s latest Primary Mortgage Market Survey (PMMS), the 30-year FRM averaged 4.01 percent for the week ending Dec. 31, up from last week’s average of 3.96 percent and above last year’s average of 3.87 percent. The 15-year FRM averaged 3.24 percent, slightly higher than last week’s 3.22 percent and above last year’s 3.15 percent average. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.08 percent this week, up from last week’s 3.06 percent and last year’s 3.01 percent.

The one-year Treasury-indexed ARM averaged 2.68 percent, unchanged from last week and above last year’s 2.40 percent. This week marks the end of Freddie Mac’s inclusion of the one-year ARM in its weekly mortgage rates reporting.

Sean Becketti, chief economist at Freddie Mac, predicted that rates will remain above the four percent level over the next 12 months.

“After averaging 3.9 percent in the fourth quarter of 2015, we expect the 30-year mortgage rate to average 4.7 percent for the fourth quarter of 2016,” Becketti said.