Mortgage Rates Experience Anemic Rise

Mortgage rates experienced very mild upticks in the latest Primary Mortgage Market Survey (PMMS) released by Freddie Mac.

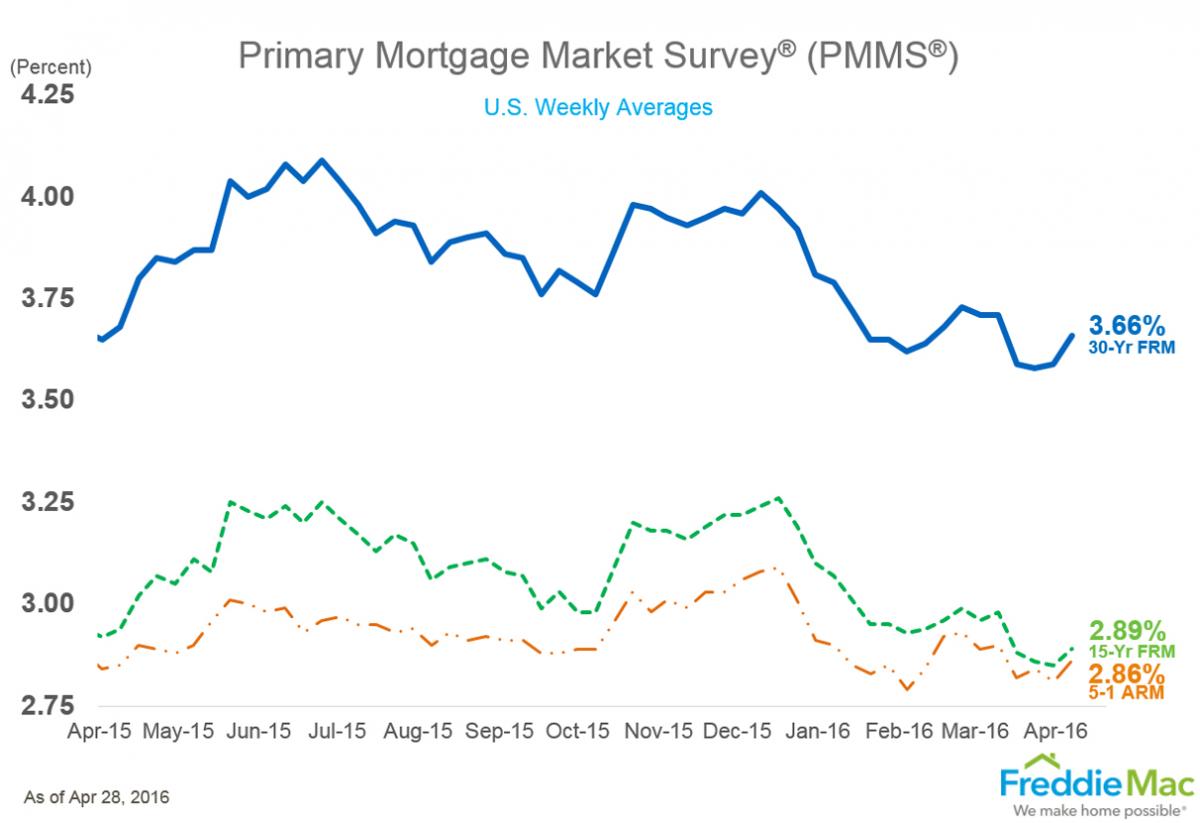

The 30-year fixed-rate mortgage (FRM) averaged 3.66 percent for the week ending April 28, up from last week’s 3.59 percent average. The 15-year FRM this week averaged 2.89, up from last week when it averaged 2.85 percent, and the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.86 percent this week up from 2.81 percent the week before.

More robust activity was measured in Freddie Mac’s Multi-Indicator Market Index (MiMi), which registered at an 83 level for March. Thirty-five of the 50 states plus the District of Columbia have MiMi values within range of their benchmark averages, with the District of Columbia (101.7), North Dakota (95.3), Hawaii (95.2), Montana (94.8) and Utah (94.6) ranking in the top five. Fifty-nine of the 100 metro areas have MiMi values within range, with Austin (100.5), Denver, (100.8), Salt Lake City (97.7), Honolulu (97.4), and Los Angeles (97.0) ranking in the top five.

Freddie Mac Deputy Chief Economist Len Kiefer viewed these numbers as evidence of a strengthening housing market.

“The U.S. housing market is poised to have its best year in a decade,” Kiefer said. “The National MiMi currently stands at 83, the highest since September of 2008. And the trends are nearly all positive. Home purchase applications are headed higher, with the National MiMi purchase applications indicator increasing nearly 12 percent from one year ago.”