California Housing Became More Affordable in Q1

The ongoing problem of housing affordability in California seemed to during the first quarter, according to new data from the California Association of Realtors (CAR).

California homebuyers needed to earn a minimum annual income of $92,571 to qualify for the purchase of a $465,280 statewide median-priced, existing single-family home in the first quarter of 2016, according to CAR. Over in the condo market, 41 percent of California households earned the CAR-measured minimum income to qualify for the purchase of a condominium or townhome in the first quarter, up from 39 percent from the fourth quarter of 2015.

The organization’s Housing Affordability Index (HAI), which measures the percentage of home buyers who could afford to purchase a median-priced, existing single-family home, rose during the first quarter to 34 percent, up from 30 percent recorded in the fourth quarter of 2015; year-over-year, the level was unchanged. This is the 12th consecutive quarter that the index has been below 40 percent and is close to the 29 percent low level from mid-2008. At its peak in the first quarter of 2012, the index hit 56 percent.

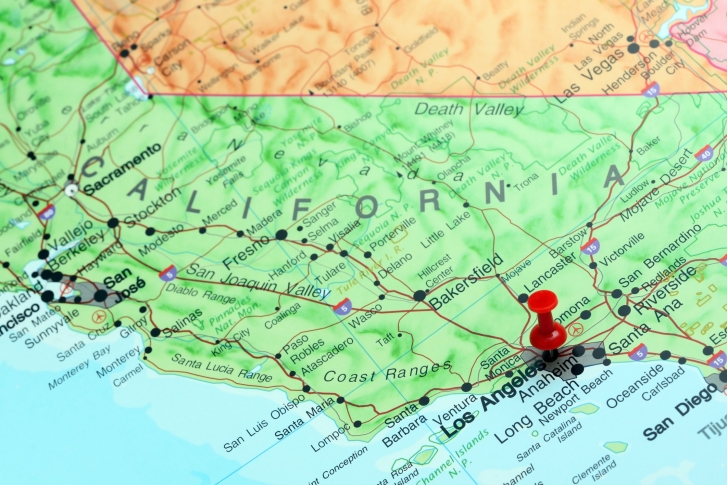

During the first quarter, the five most affordable counties in California were Kings (58 percent), San Bernardino (57 percent), Merced (55 percent), and Kern (55 percent). The least affordable counties were San Francisco (13 percent), San Mateo (16 percent) and Santa Cruz (18 percent).