A Thumbs-Up Thursday for Housing

Today’s housing data news offered a healthy serving of mostly good news.

The home sales volume experienced a 7.5 percent increase from March to April, according to new data from RE/MAX. On a year-over-year measurement, April’s home sales were up 3.2 percent from April 2015. In the 53 metro areas surveyed by RE/MAX in April, 34 markets reported higher year-over-year sales and 16 reported double-digit increases.

The median sales price in April was $215,000, up 7.5 percent from March and up 5.4 percent from April 2015. April was the 51st consecutive month without a drop in price from the previous year. The average number of days on the market for all homes sold in April was 64, down seven days from the average of 71 in both March and April 2015. April was the 37th consecutive month where the days on the market average was 80 or less.

However, inventory remained problematic: the number of homes for sale in April was a scant 0.2 percent lower than in March, but was a significant 15.2 percent drop from April 2015. The average loss of inventory on a year-over-year basis in 2015 was 12.2 percent. But Dave Liniger, RE/MAX’s chairman and CEO, was not concerned that low inventory rates would create major damage.

“Even though inventory remained tight, April still saw a demand for homes at a level higher than one year ago,” he said. “Homebuyers realize that interest rates are historically low and mortgage accessibility appears to be improving along with the overall economy. Price increases make it possible for homeowners to feel comfortable selling, but they aren’t at a level that keeps first-time buyers out of the market.”

Separately, the volume of cash sales continued to show year-over-year declines, according to new data from CoreLogic. Cash sales accounted for 35.7 percent of total home sales in February, down 2.5 percent from the 38.1 percent level in February 2015. Although cash sales activity increased by 0.1 percentage point in February compared with January, the cash sales share in the first two months of this year averaged 35.6 percent, the lowest start to any year since 2008.

Real estate-owned sales had the largest cash sales share in February at 59.2 percent, followed by resales at 35.6 percent, short sales at 32.6 percent and newly constructed homes at 15.2 percent. Alabama had the largest cash sales share by state at 51.7 percent, while Philadelphia had the highest cash sales share by metro area at 54.5 percent.

There was more good news from the S&P/Experian Consumer Credit Default Indices, which found mortgage defaults declining last month. First mortgage defaults reported a 0.69 percent rate for April, down eight basis points from March, while second mortgage defaults were at a 0.58 percent rate last month, one basis point below the previous month.

“Since the financial crisis, consumers are paying more attention to their debts, particularly longer term financial commitments such as homes and autos,” said David M. Blitzer, managing director and chairman of the Index Committee at S&P Dow Jones Indices. “The Mortgage Debt Service Ratio—the percentage of disposable income going to service mortgage debt—is at its lowest point since 1980. The Total Debt Service Ratio, which includes loans with scheduled payments, is close to a record low. The savings rate is now at about percent of disposable income, slightly higher than its level in 2004-2006. In contrast to the low default rates on mortgages and auto loans, bank cards recently showed increased default rates.”

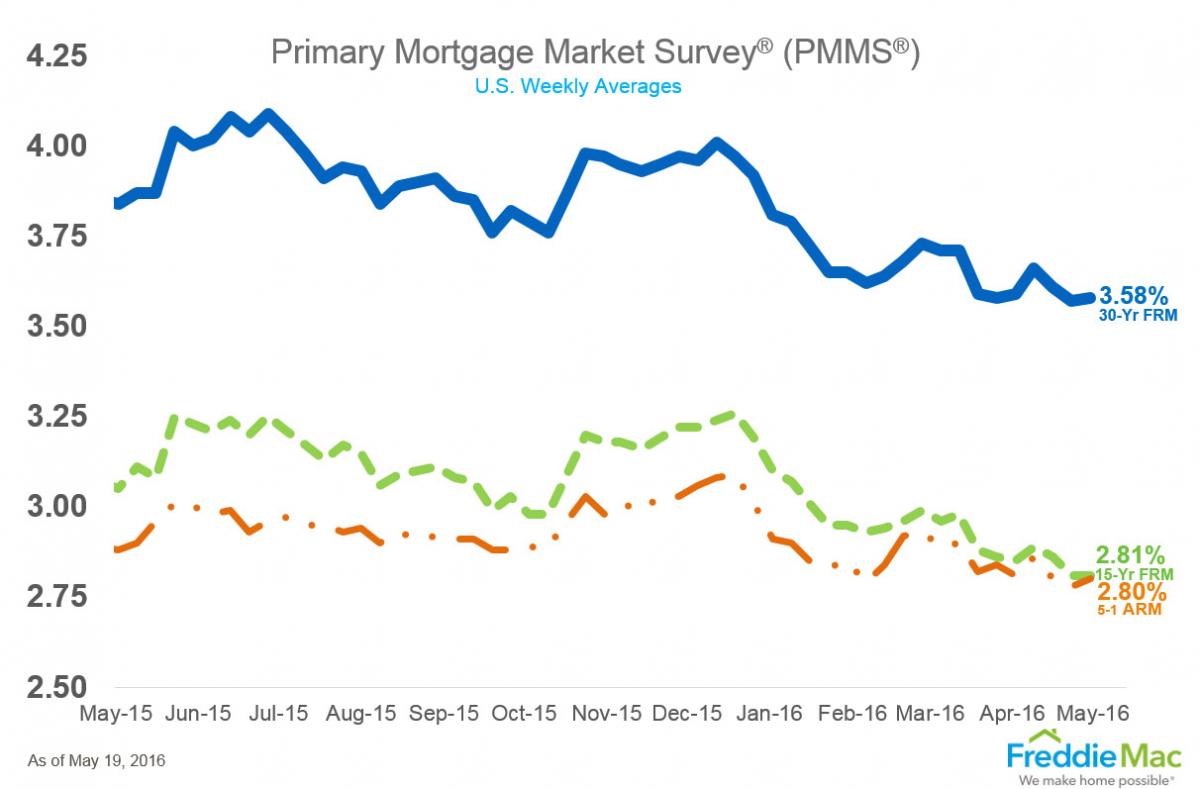

As for mortgage rates, they remained near their 2016 lows, according to Freddie Mac’s Primary Mortgage Market Survey. The 30-year fixed-rate mortgage (FRM) averaged 3.58 percent for the week ending May 19, a slight bump up from last week when it averaged 3.57 percent. The 15-year FRM this week averaged 2.81 percent, unchanged from last week, while the 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.80 percent this week, up last week’s 2.78 percent.

But Sean Becketti, chief economist at Freddie Mac, predicted that a rate ascension was on the near-horizon.

“Although there was minimal change in rates this week, the hawkish tone of Wednesday's Fed minutes release had an immediate impact on Treasury yields, and could possibly shake up next week's survey results,” he stated.