Housing Starts Stagnate, Housing Sales Rise

Housing starts did not enjoy much traction in May, but that did not create much concern in the industry, while housing sales enjoyed a healthy upswing, according to the latest market data.

Housing starts did not enjoy much traction in May, but that did not create much concern in the industry, while housing sales enjoyed a healthy upswing, according to the latest market data.

Single-family housing starts in May were at a rate of 764,000, which is a scant 0.3 percent above the revised April figure of 762,000, according to new statistics released by the U.S. Census Bureau and the Department of Housing and Urban Development. But privately-owned housing starts last month were at a seasonally adjusted annual rate of 1,164,000, which is 0.3 percent below the revised April estimate of 1,167,000—however, it is also 9.5 percent above the May 2015 rate of 1,063,000.

Single-family authorizations in May were at a rate of 726,000, which is two percent below the revised April figure of 741,000. Yet privately-owned housing units authorized by building permits in May were at a seasonally adjusted annual rate of 1,138,000, which is 0.7 percent above the revised April rate of 1,130,000—yet it is also 10.1 percent below the May 2015 estimate of 1,266,000.

There was more stability regarding housing completions: single-family housing completions in May were at a rate of 717,000, which is 2.3 percent above the revised April rate of 701,000, and privately-owned housing completions in May were at a seasonally adjusted annual rate of 988,000, which is 5.1 percent above the revised April estimate of 940,000—but, nonetheless, it is 3.5 percent below the May 2015 rate of 1,024,000.

While these number were not particularly vibrant, industry reaction did not betray any great agitation.

“Following a slight comeback in April, May's housing starts took a dip, but the revisions may reveal something different,” said Ray Rodriguez, regional mortgage sales manager for TD Bank. “In addition, we remain optimistic that we will see an increase in the coming months to support the ongoing recovery of the housing market.”

“Collectively, recent readings on new construction show little change from what we have already been observing this spring: Total permits are down on a year-over-year basis because of a substantial decline in multi-family construction, and single-family construction is continuing to show gains, but the monthly pattern is erratic,” said Jonathan Smoke, chief economist at Realtor.com. “Starts, on the other hand, are still showing year-over-year gains in total, for both single-family and multifamily.”

Yet Smoke warned that a slowdown in homebuilders’ output could create problems.

“The most troubling sign in this year’s new construction data is the continued trend of four straight months of starts exceeding permits,” he continued. “This is an important signal that builders are slowing expansion. With starts exceeding permits, and permits on decline on a year-over-year basis, it appears that we will have even fewer starts and completions six months down the road.”

But Ed Brady, chairman of the National Association of Home Builders (NAHB), acknowledged some problems were present, but mostly disputed the severity of Smoke’s diagnosis.

“Builders in many markets across the nation are reporting higher traffic and more committed buyers at their job sites,” he said. “However, our members are also relating ongoing concerns regarding the shortage of buildable lots and labor and noting pockets of softness in scattered markets.”

Brady’s comments came with the release of the NAHB/Wells Fargo Housing Market Index, which rose two points this month to hit the 60 level, its highest reading since January 2016. The three segments that make up the index all registered increases: The component gauging current sales conditions rose one point to 64, the index charting sales expectations in the next six months increased five points to 70, and the component measuring buyer traffic climbed three points to 47.

“Rising home sales, an improving economy and the fact that the HMI gauge measuring future sales expectations is running at an eight-month high are all positive factors indicating that the housing market should continue to move forward in the second half of 2016,” said NAHB Chief Economist Robert Dietz.

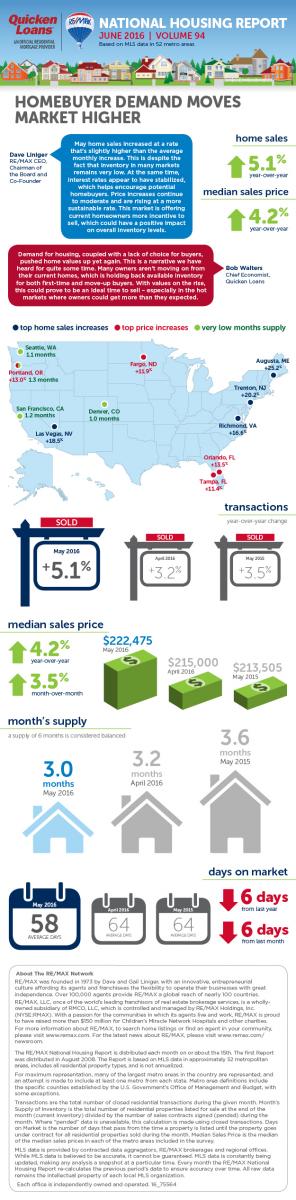

Also on the rise, according to RE/MAX, are housing sales. The company’s latest data analysis determined that home sales in May increased 10.3 percent from April and were 5.1 percent higher from a year earlier. The median sales price in May was $222,475, up 3.5 percent from the previous month and up 4.2 percent from a year earlier.

But one thing that was not on the rise was inventory. RE/MAX reported that May’s inventory was 14.8 percent below last year’s level, while the average for days on the market for all homes sold in May was 58, down six days from the average of 64 from the previous month and one year earlier. Dave Liniger, RE/MAX CEO and chairman, noted that a tight inventory level did not handcuff sales activity.

“May home sales increased at a rate that’s slightly higher than the average monthly increase,” he said. “This is despite the fact that inventory in many markets remains very low. At the same time, interest rates appear to have stabilized, which helps encourage potential homebuyers. Price increases continue to moderate and are rising at a more sustainable rate. This market is offering current homeowners more incentive to sell, which could have a positive impact on overall inventory levels.”