Existing-Home Sales Up, But Problems Persist

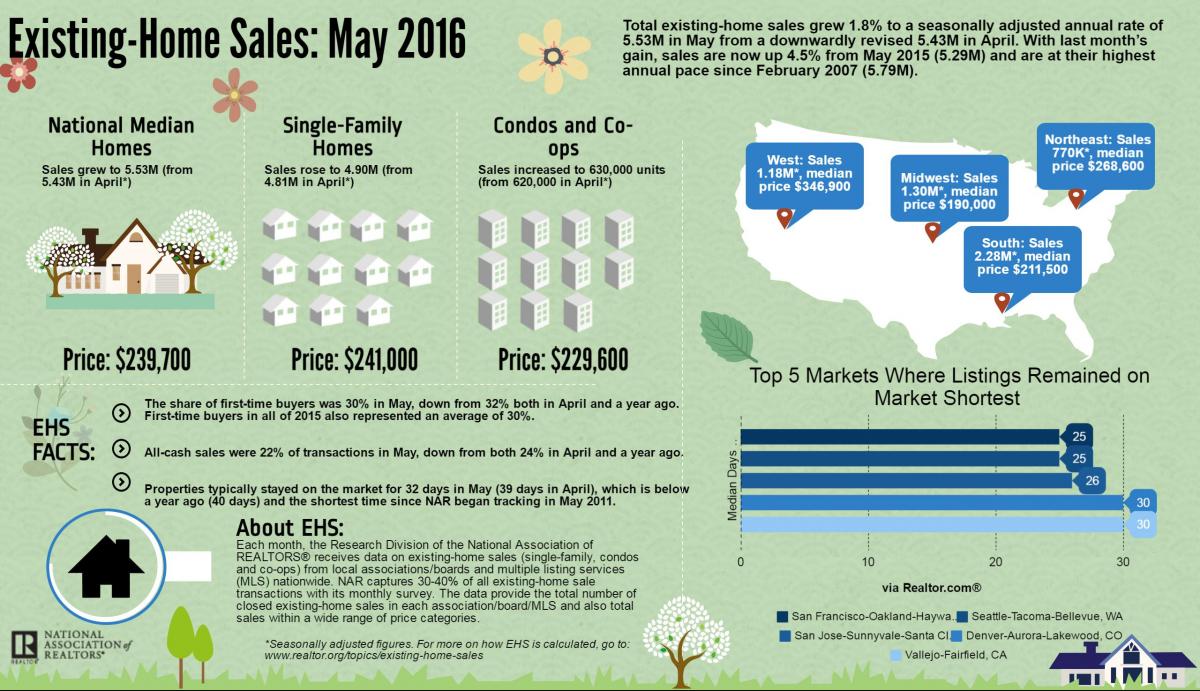

Existing-home sales increased 1.8 percent to a seasonally adjusted annual rate of 5.53 million in May from a downwardly revised 5.43 million in April, according to new data from the National Association of Realtors (NAR). Last month’s sales level also marked a 4.5 percent year-over year increase and was the highest annual level since February 2007.

All-cash sales were 22 percent of transactions in May, down from both 24 percent in April and a year ago. Distressed sales declined to six percent of sales in May, down from seven percent in April and 10 percent a year ago.

Nonetheless, the latest NAR data betrayed some signs of concern: the share of first-time buyers was 30 percent in May, down from 32 percent both in April and a year ago, while properties typically stayed on the market last month for 32 days, down from April’s 39-day average. Forty-nine percent of homes sold in May were on the market for less than a month, which is the highest percentage ever recorded by NAR.

As for total housing inventory, May’s level of 2.15 million existing homes available for sale remained 5.7 percent below the May 2015 of 2.28 million. The unsold inventory is at a 4.7-month supply at the current sales pace, which is unchanged from April.

Lawrence Yun, NAR chief economist, acknowledged the problems that faced the housing market.

“This spring’s sustained period of ultra-low mortgage rates has certainly been a worthy incentive to buy a home, but the primary driver in the increase in sales is more homeowners realizing the equity they’ve accumulated in recent years and finally deciding to trade-up or downsize,” Yun said. “With first-time buyers still struggling to enter the market, repeat buyers using the proceeds from the sale of their previous home as their down payment are making up the bulk of home purchases right now. Barring further deceleration in job growth that could ultimately temper demand from these repeat buyers, sales have the potential to mostly maintain their current pace through the summer.”