Mixed Results on Q1 Home-Related Delinquencies

Consumer delinquencies on home-related lending were down in two out of four categories during the first quarter of this year, according to the latest American Bankers Association’s (ABA) Consumer Credit Delinquency Bulletin.

The composite ratio—used by the ABA to track delinquencies in eight closed-end installment loan categories—dropped by three basis points (bps) to 1.38 percent of all accounts. On the homeownership front, home equity line delinquencies declined three bps to 1.15 percent of all accounts and property improvement loan delinquencies dipped three bps to 0.89 percent of all accounts.

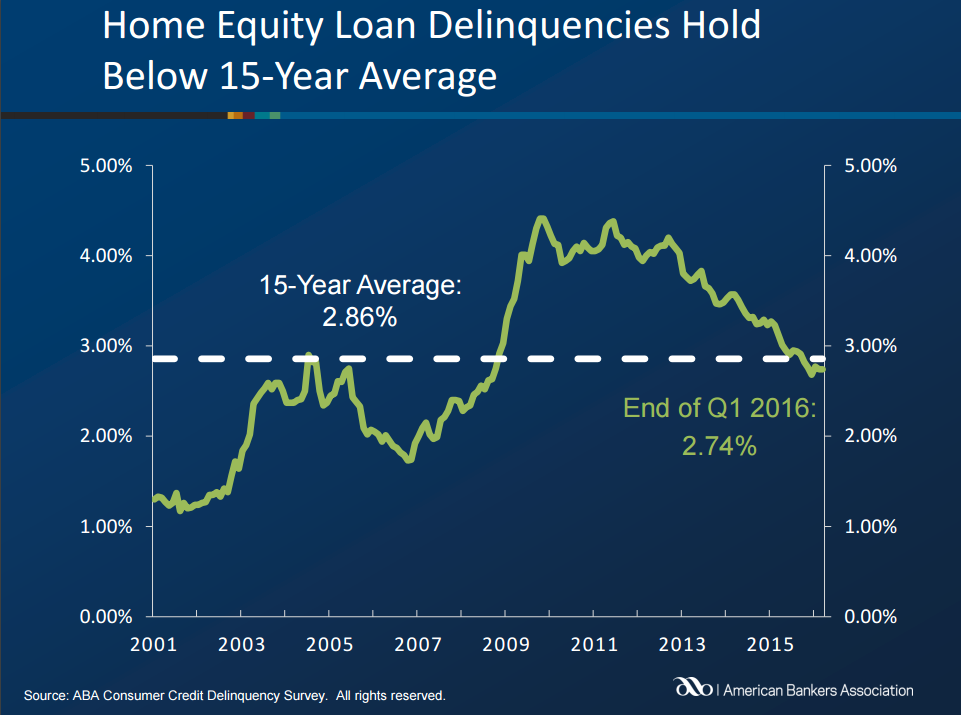

Home equity loan delinquencies, however, rose six bps points to 2.74 percent of all accounts—an unexpected uptick, considering this category saw a 23 bps tumble in the previous quarter. The most dramatic upswing involved the niche category of mobile home delinquencies, which rose 25 bps to 3.41 percent.

“As the housing market continues its slow and steady recovery, consumers have more valuable equity at stake, which makes their loan payments even more of a top priority,” said James Chessen, ABA’s chief economist. “Growing equity also makes new home equity loans a viable option for qualified home owners. The market for home equity loans and lines will likely continue to grow as a larger pool of qualified borrowers looks to take advantage of low rates to make property improvements or pay off higher-interest debt.”