Foreclosure Inventory Hits Nine-Year Low

The U.S. foreclosure inventory took a dramatic 24.5 percent year-over-year plummet in May, reaching its lowest level since October 2007, while the number of completed foreclosures declined by 6.9 percent from 41,000 in May 2015 to 38,000 in May 2016, according to new data from CoreLogic.

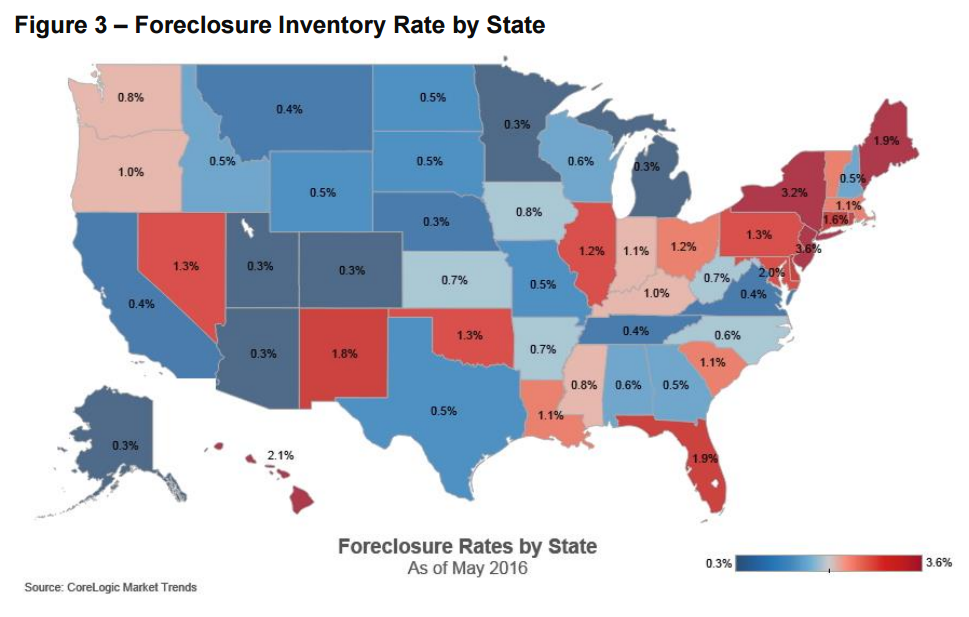

As of May 2016, the national foreclosure inventory consisted of approximately 390,000 mortgaged properties, or one percent of all homes with a mortgage, versus 517,000 homes, or 1.3 percent, one year earlier. Also in decline during May was the number of mortgages in serious delinquency: a 21.6 percent year-over-year fall with 1.1 million mortgages, or 2.8 percent, in this category. The serious delinquency rate for May was the lowest since October 2007.

The five states with the highest number of completed foreclosures—Florida (63,000), Michigan (45,000), Texas (27,000), Ohio (23,000) and California (23,000)—represented nearly half of all completed foreclosures nationally, while the District of Columbia had the lowest number of completed foreclosures in May with 139.

“Delinquency and foreclosure rates continue to drop as we experience the benefits of a combination of tight underwriting, job and income growth and a steady rise in home prices,” said Anand Nallathambi, president and CEO of CoreLogic. “We expect these factors to remain in place for the remainder of this year and for delinquency and foreclosure rates to decline even further. As we finally move past the housing crisis, we need to increase our focus on expanding the supply of affordable housing and access to credit for first-time homebuyers in sustainable ways to ensure the long-term health of the U.S. housing market.”