Step Inside Ginnie Mae: The Ginnie Mae Model

The simple but strong business model that Ginnie Mae has built highlights the power of the federal government and the private sector working together. Through the efficiency and low-cost securitization of the model, Ginnie Mae fulfills the needs and demands of various market segments by leveraging the full faith and credit of the U.S. government to access global capital.

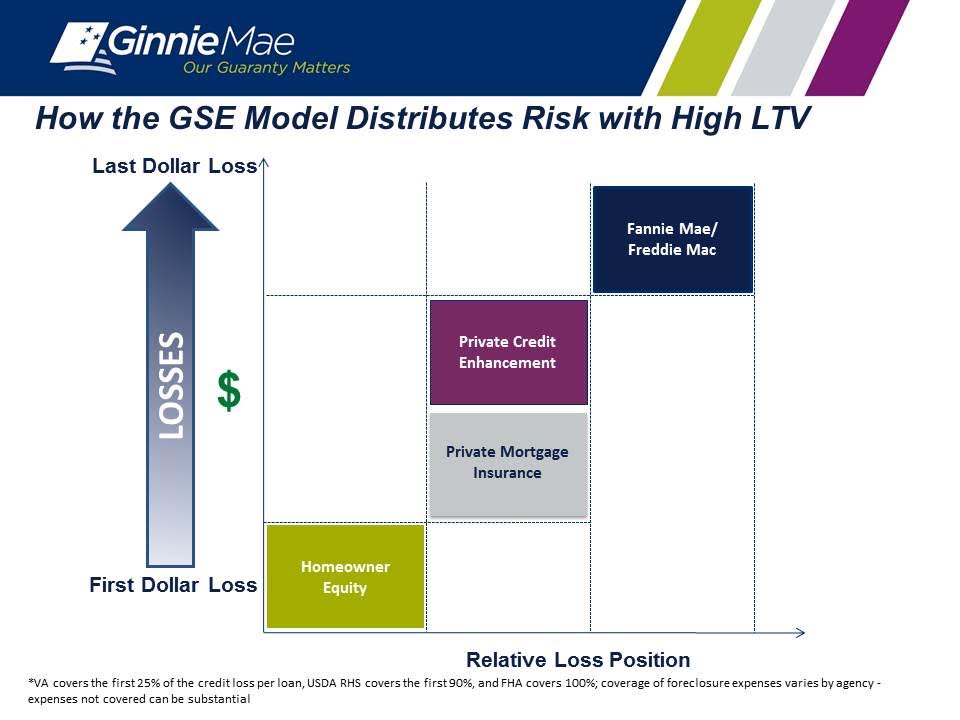

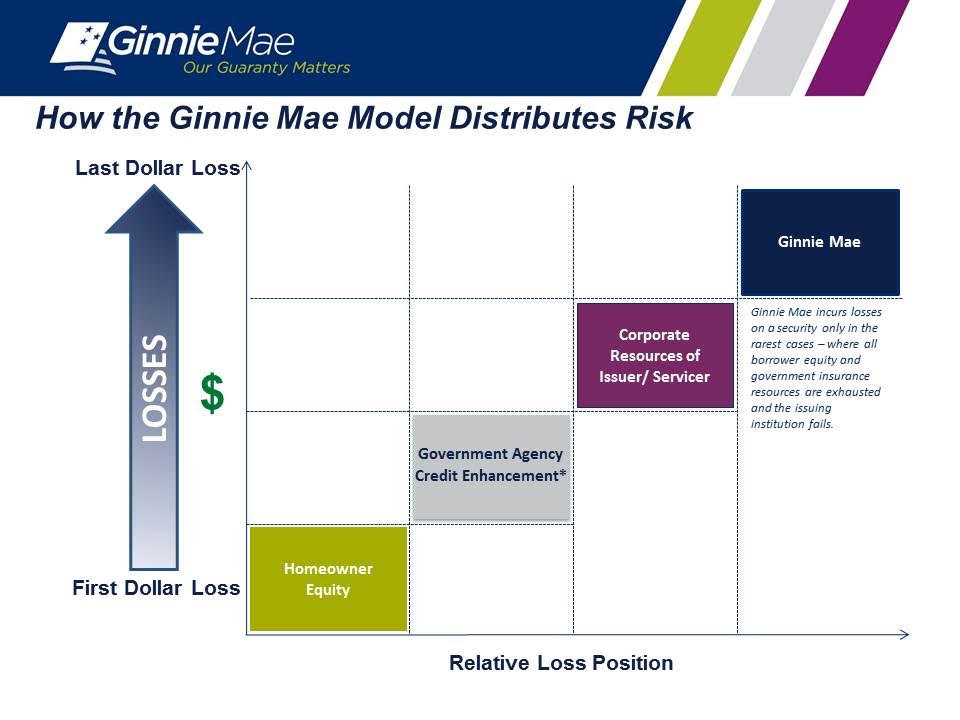

Unlike the GSEs, Ginnie Mae's business model significantly limits the taxpayers' exposure to risk associated with secondary market transactions. Its strategy is to guarantee a simple pass-through security to lenders rather than buy loans and issue its own securities.

Because private lending institutions originate eligible loans, pool them into securities and issue Ginnie Mae mortgage-backed securities (MBS), the corporation's exposure to risk is limited to the ability and capacity of its MBS Issuer partners to fulfill their obligations to pay investors. By guaranteeing the servicing performance of the issuer—not the underlying collateral—Ginnie Mae insulates itself from the credit risk of the mortgage loans.

With Ginnie Mae in the fourth loss position, three layers of risk protection are exhausted before Ginnie Mae is at risk. Additionally, the failure of an issuer will cause Ginnie Mae to experience financial loss only to the extent that funds are needed to transfer the servicing to another Issuer or to the extent there is deterioration in servicing value.

Ted W. Tozer is was sworn in as president of Ginnie Mae on Feb. 24, 2010, bringing with him more than 30 years of experience in the mortgage, banking and securities industries. As president of Ginnie Mae, Tozer actively manages Ginnie Mae's $1.5 trillion portfolio of mortgage-backed securities (MBS) and more than $460 billion in annual issuance.

This article originally appeared in the June 2016 print edition of National Mortgage Professional Magazine.