Mortgage Servicers Urged to Enhance Customer Experiences

Mortgage servicers that make the customer experience a priority will reap the benefits in profits and reputation, according to the J.D. Power 2016 Primary Mortgage Servicer Satisfaction Study. In presenting this finding, J.D. Power warned services against taking customers for granted.

"Servicers with a captive audience can often view taking measurable steps that improve the customer experience as an unnecessary investment," said Craig Martin, senior director of the mortgage practice at J.D. Power. "They aren't against improving satisfaction, but cost containment is their top priority. The study clearly shows, however, that interacting with customers more efficiently—and more effectively—can reduce costs and increase profit for servicers regardless of the business model, while having the added bonus of improving satisfaction."

The new study cited a reduction in customer complaints (and subsequent inquiries from enforcement-focused regulators), cost-effectiveness, the limiting of portfolio loss and the opportunity to build new business as the key reasons to enhance and solidify the customer experience. The study also advocated the use of a user-friendly website, which could result in fewer calls to live agents as customers seek out answers to their questions online.

"Most servicers tend to focus on the complaints they receive, but the truly successful servicers get to the root causes of problems and take a more proactive approach," Martin said. "They realize better communication and self-service options can help their bottom line by reducing unnecessary calls."

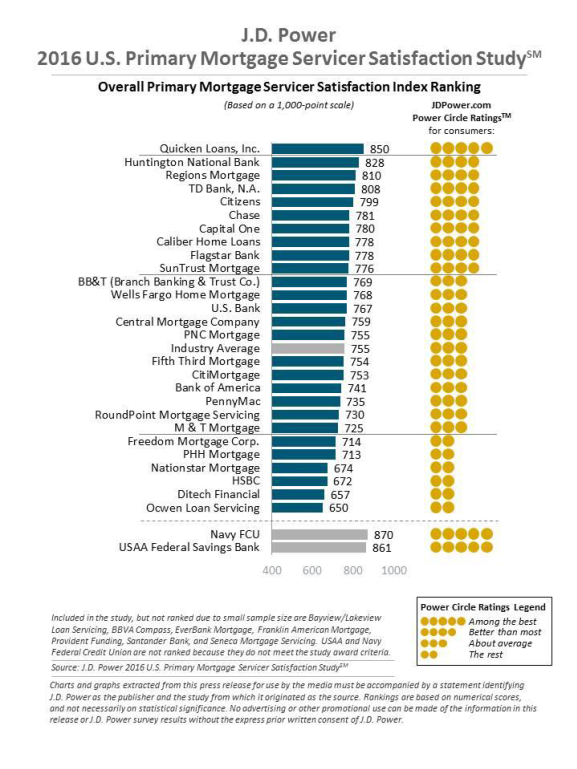

J.D. Power also ranked the nation’s largest servicers on a 1,000-point scale, with Quicken Loans scoring the highest rating with 850 points. Huntington National Bank came in second with a score of 828, while Regions Mortgage ranked third with a score of 810—a 77-point improvement from the 2015 study.