Study: Lower Distressed Sales Disrupts West Coast Affordability

A situation that could be considered as an example of good news—the decline in distressed housing levels—is actually creating something of a problem in regard to housing affordability in some West Coast markets, according to Clear Capital’s August 2016 Home Data Index market report.

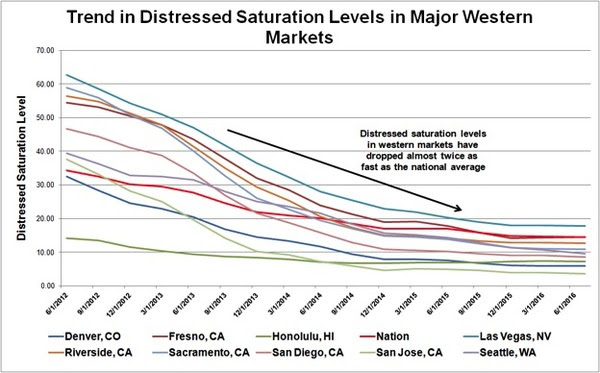

In Clear Capital’s analysis, distressed properties in many of the region’s top markets have steadily decreased at a rate that is greater than that of the national average. Although the national level of distressed properties is now measured at 14.5 percent, housing markets in Seattle, San Diego, Honolulu and Las Vegas are now under the 10 percent mark—with San Jose recording distressed properties as only three percent of overall sales in the market.

“Because distressed saturation levels are one of the key indicators of a market’s overall health, low frequencies of these sales in the market could be a sign of a healthy market,” said Alex Villacorta, vice president of research and analytics at Clear Capital. “However, as REO and short sale properties become harder and harder to come by in the region, this could be a signal that affordability is continuing to plummet. This, coupled with an observed rapid increase in price and a potential uptick in interest rates in the near future, may spell trouble for the region in the coming months and years as low tier investors and first time homebuyers are continually shut out of major Western markets.”

Clear Capital determined that Western markets are experiencing overall quarterly growth at approximately 1.4 percent, with some markets outperforming that average by almost half a percent. Southern markets are experiencing a 0.8 percent quarterly overall growth, greater than the national average of 0.7 percent quarter-over-quarter growth.