Foreclosure Inventory Hits Nine-Year Low

The U.S. foreclosure inventory plummeted by 25.9 percent on a year-over-year basis in June, according to new data from CoreLogic. The national foreclosure inventory in June encompassed approximately 375,000, or one percent, of all homes with a mortgage—this is the lowest level for any month since August 2007.

There were 38,000 completed foreclosures in June, down 4.9 percent from the 40,000 level set one year earlier. The number of mortgages in serious delinquency took a significant 21.3 percent drop from June 2015 to June 2016. The 1.1 million mortgages, or 2.8 percent, in this category represented the lowest serious delinquency rate since September 2007.

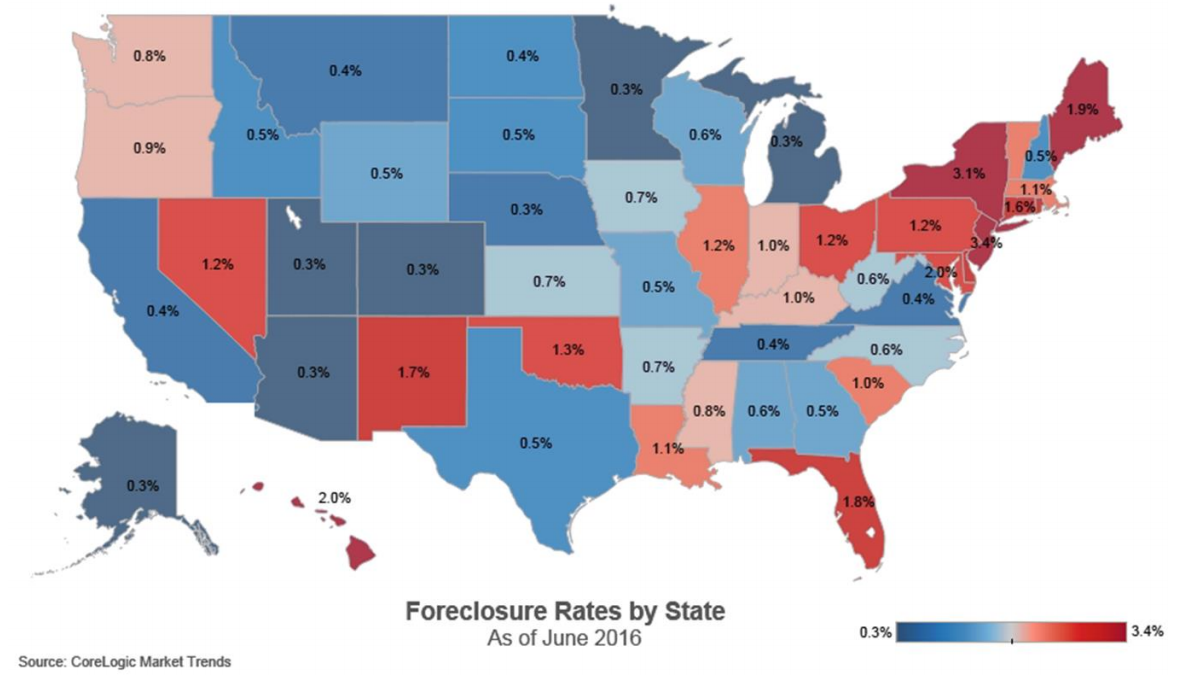

On a month-over-month basis, the foreclosure inventory in June was down 3.6 percent compared with May 2016, but the level of completed foreclosures increased by 5.1 percent from May—albeit a difference of 2,000 completed foreclosures. The five states with the highest number of completed foreclosures in the 12 months ending in June—Florida (60,000), Michigan (47,000), Texas (27,000), Ohio (23,000) and California (22,000)—accounted for almost 40 percent of all completed foreclosures nationally.

"The impact of the inexorable reduction over the past several years in both foreclosure trends and serious delinquencies is driving the long-awaited return to more historic norms for the U.S. housing market," said Anand Nallathambi, president and CEO of CoreLogic. "We expect the combination of continued home price appreciation of more than five percent and rising employment levels in the year ahead will help cement the gains we have had and perhaps accelerate them."