Little Progress to Report in Latest Mortgage Data

For those looking to enjoy a strong dose good news on the mortgage origination front, this is not your day.

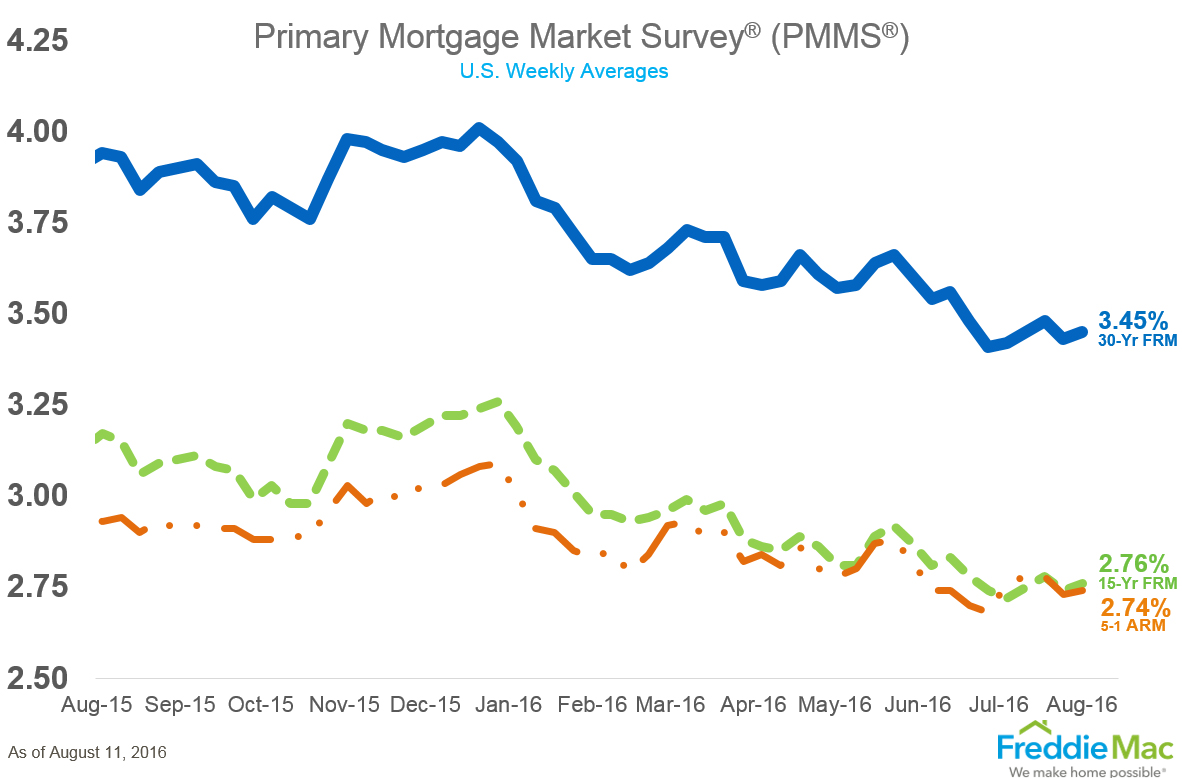

Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) saw anemic progress. The 30-year fixed-rate mortgage (FRM) averaged 3.45 percent for the week ending August 11, barely up from last week when it averaged 3.43 percent. And the 15-year FRM this week averaged 2.76 percent, also barely up from last week when it averaged 2.74 percent. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.74 percent this week, a scant uptick from last week when it averaged 2.73 percent. A year ago, the five-year ARM averaged 2.93 percent.

But despite historically low rates, mortgage applications for new home purchases fell by eight percent from June to July, according to the latest Mortgage Bankers Association (MBA) Builder Application Survey data. However, July’s level was 2.4 percent higher from a year ago.

The MBA estimated new single-family home sales at a seasonally adjusted annual rate of 540,000 units in July, an increase of 1.9 percent from the June pace (530,000). But on an unadjusted basis, the MBA estimated 45,000 new home sales in July, a 4.3 percent drop from 47,000 new home sales in June. Also in decline was the average loan size of new homes: $325,843 in July versus $326,175 in June.

Nonetheless, MBA Vice President of Research and Economics Lynn Fisher maintained a keep-calm-and-carry-on attitude regarding these numbers.

"Month over month declines in applications are part of the normal seasonal pattern this time of year," Fisher said. "Mortgage applications to home builders in July increased at the slowest year over year pace to date in 2016 at just 2.4 percent over a year ago."