HOPE NOW: 100K Loan Mods in Q2 of 2016

More than 100,000 permanent loan modifications were completed during the second quarter, according to new data released by HOPE NOW, a 16 percent increase from the previous quarter. From that total, roughly 69,000 proprietary loan modifications were transacted while approximately 31,000 homeowners received modifications under the Home Affordable Modification Program (HAMP).

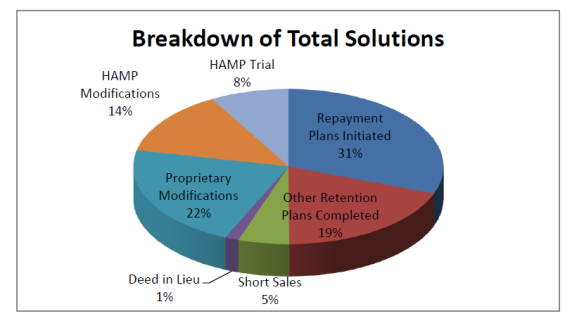

During the second quarter, approximately 335,000 homeowners received non-foreclosure solutions from mortgage servicers. HOPE NOW estimated that for every one foreclosure sale in the second quarter, mortgage servicers offered 4.14 solutions. Serious delinquencies of 60 days or more declined 10 percent from 1.72 million in first quarter to 1.54 million in the second quarter, while foreclosure sales also fell 10 percent from 91,000 in the first quarter to 81,000 in the second quarter.

“The second quarter data report confirms the continuous decline of serious delinquency rates across the country,” said Eric Selk, HOPE NOW’s executive director. “With the lowest reported total to date, markets continue to make recovery from the housing crisis. For those homeowners who still face struggles with affording their mortgage, there are a plethora of options available to them. HOPE NOW servicers remain committed to assisting homeowners avoid foreclosure.”