Foreclosure Inventory at Nine-Year Low

The U.S. foreclosure inventory plummeted 29.1 percent in July on a year-over-year measurement, while the volume of completed foreclosures fell from 41,000 in July 2015 to 34,000 one year later, a 16.5 percent slide, according to new data from CoreLogic.

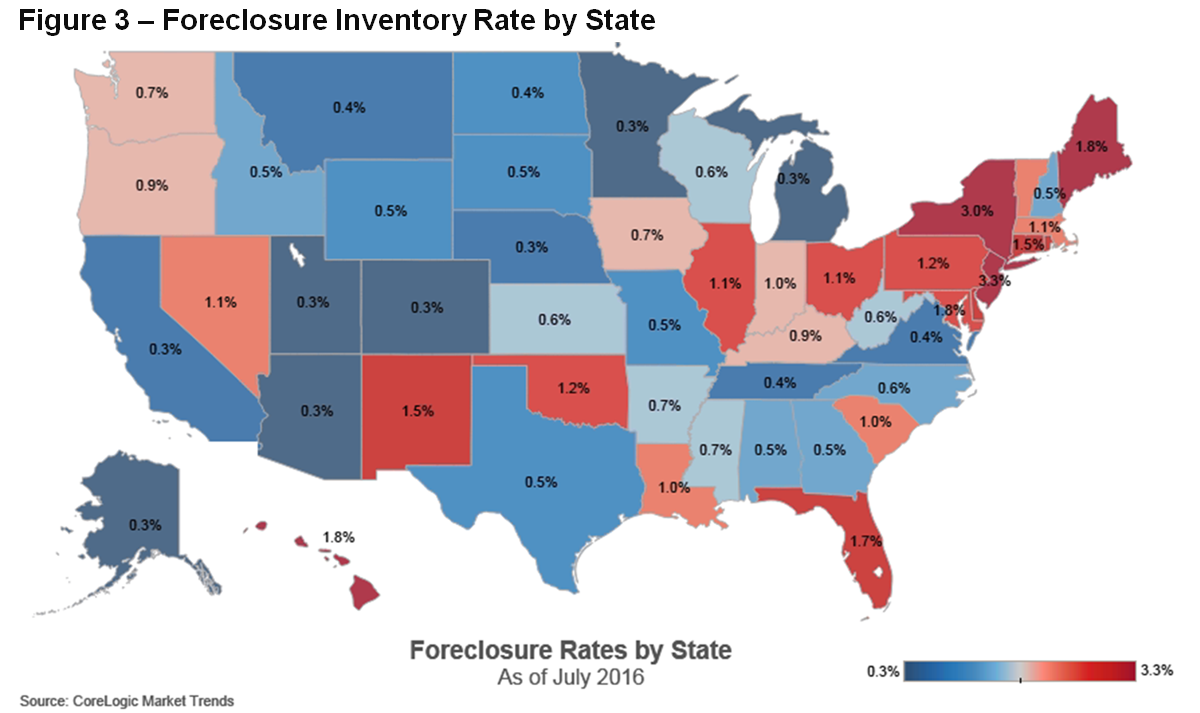

The national foreclosure inventory included approximately 355,000 homes in July, or 0.9 percent of all residential properties, which is the lowest level for any month since August 2007. One year earlier, the foreclosure inventory stood at 501,000 homes, or 1.3 percent of all residential properties.

CoreLogic also reported that the number of mortgages in serious delinquency dropped 17.3 percent from July 2015 to July 2016, with 1.1 million mortgages, or 2.9 percent, in this category. The decline encompassed 47 states and the District of Columbia.

The five states with the highest number of completed foreclosures in the 12 months ending in July were Florida (57,000), Michigan (45,000), Texas (27,000), Ohio (23,000) and California (21,000). These five states account for almost 40 percent of all completed foreclosures nationally.

"Loan modifications, foreclosures and stronger housing and labor markets have each played a role in bringing the foreclosure rate to the lowest level in nine years," said Frank Nothaft, chief economist for CoreLogic. "The U.S. Treasury's Making Home Affordable program has contributed to the decline through permanent modifications, forbearance and foreclosure alternatives which have assisted 2.5 million homeowners with first mortgages at risk of foreclosure since 2009."