Pessimism Pervades Buying and Appraisal Surveys

Autumn is arriving next week, and the latest Housing Opportunities and Market Experience survey conducted by the National Association of Realtors (NAR) gives the impression that fewer people believe that the cooler weather months are the right time for purchasing a house.

In the third quarter edition of NAR’s survey, which tapped the insight of 2,761 households, 78 percent of homeowners and 60 percent of renters said it is a good time to buy. This is down from the previous quarters of the year: the second quarter had 80 percent of homeowners and 62 percent of renters, while the first quarter had 82 percent of homeowners and 62 percent of renters were optimistic about home buying.

Furthermore, 63 percent of homeowners surveyed by NAR said it is a good time to sell, up from 61 percent in the second quarter, while 91 percent of the total respondent base said prices will either stay the same or rise in their community over the next six months, down slightly from 93 percent in the previous quarter.

As for financing, respondents that were 65 and older (43 percent) and under the age of 35 (37 percent) were the most likely to believe they need more than 20 percent in a down payment if they were to pursue homeownership.

Lawrence Yun, NAR’s chief economist, expressed bafflement over the survey’s results.

“Very affordable mortgage rates and strong job gains among young adults should be translating to a higher rate of homeownership,” Yun said. “It’s not, and as a result, sales to first-time buyers remain stuck below a third of all sales.”

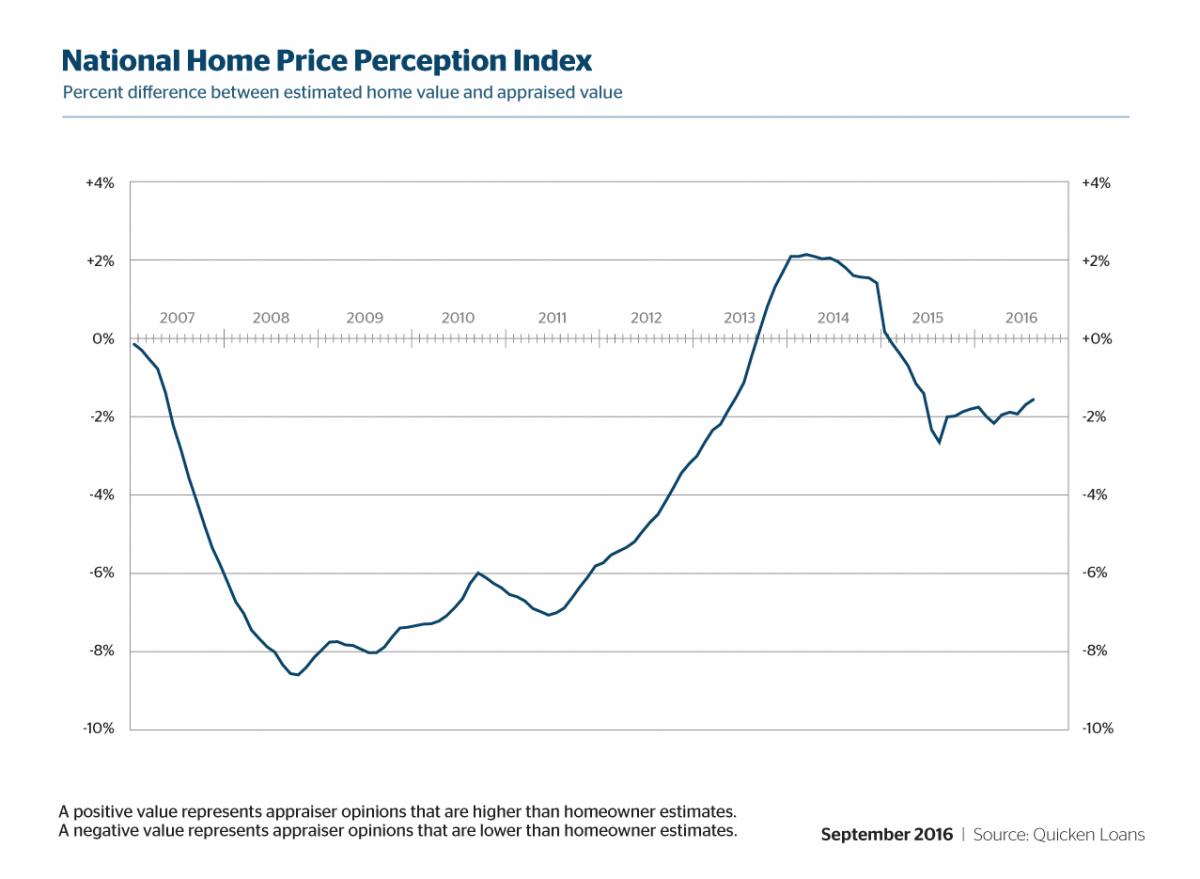

Separately, Quicken Loans reported that appraisals on residential properties in August were an average of 1.56 percent lower than what refinancing homeowners anticipated, even though home values increased 1.73 percent from July to August and were 8.13 percent higher than August 2015.

“While a one and a half percent difference may not seem like a big disparity of home value opinions, the gap could cause problems, especially in areas with an even wider difference,” said Quicken Loans Chief Economist Bob Walters. “In some portions of the Midwest, where appraisals are averaging two to three percent less than what was expected, this will often lead to restructuring a refinance or the homeowner needing to bring a few more thousand dollars to the closing table.”