Study Finds Immigrant Homeownership Rates Rising Fast

In the pursuit of the American dream, immigrant households are gaining ground on native-born Americans in terms of homeownership rates, according to a new report issued by Trulia.

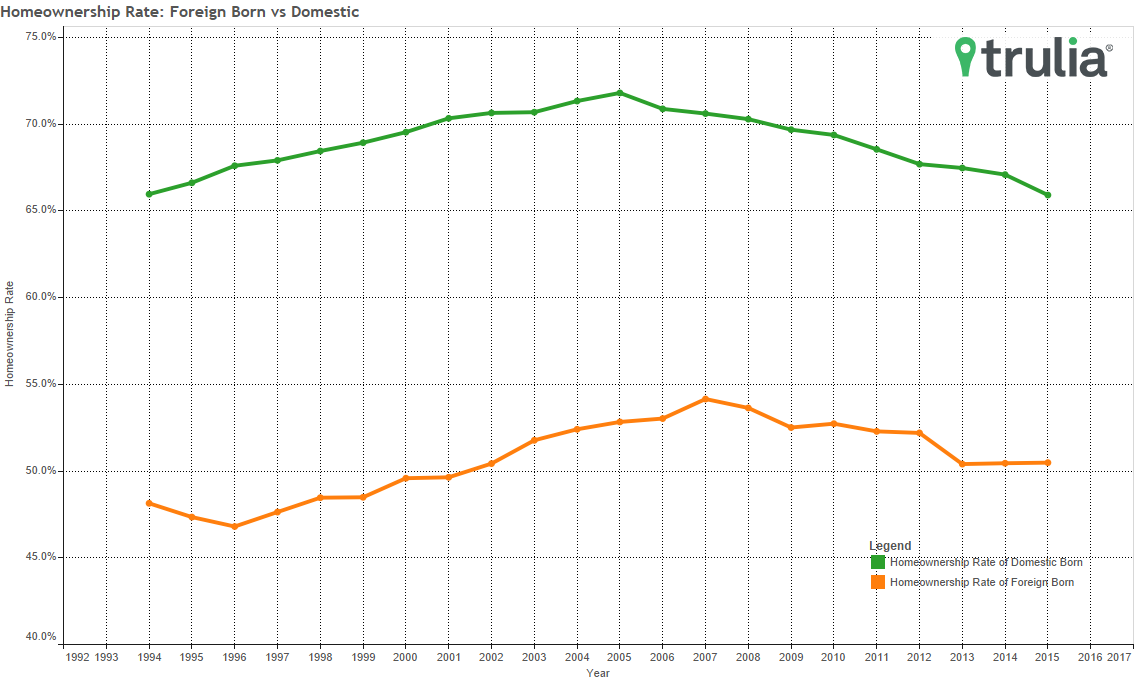

In its report titled “Immigration Nation: Homeownership and Foreign-Born Residents,” Trulia noted that the 1994 homeownership rate of those born in the U.S. was 66 percent while that of the foreign born was 48.1 percent, a 17.8 percentage point difference. That disparity grew to a 20.7 percentage point difference by 2001, but in 2015 the disparity shrank to 15.4 percentage points. During that period, Trulia found the homeownership rate of native-born Americans remained mostly unchanged, with the immigrant rate fueling the gap closure.

However, the disparity varies among housing markets. For example, the cap in New York is 20.1 percentage points, while in California it is 9.7 percentage points.

Furthermore, Mark Uh, a data scientist at Trulia, noted that immigrants who lived in the U.S. less than five years had a much lower homeownership rate than immigrants residing in this country for 10 or more years.

"This is likely due to the fact that immigrants who lived in the U.S. less than five years do not have adequate credit history in the U.S. to obtain a mortgage, which forces them to rent rather than own," Uh said. "Thus, those states with a greater proportion of foreign-born having lived in the U.S. for longer durations saw higher rates of homeownership. Concurrently, the higher the homeownership rate of foreign-born households, the more likely it is that the difference in homeownership rate between foreign-born households and U.S.-born households is smaller."