Distressed and All-Cash Sales at Nine-Year Low

Distressed home sales and all-cash home purchases each hit a nine-year low during the third quarter, according to the latest U.S. Home Sales Report issued by ATTOM Data Solutions.

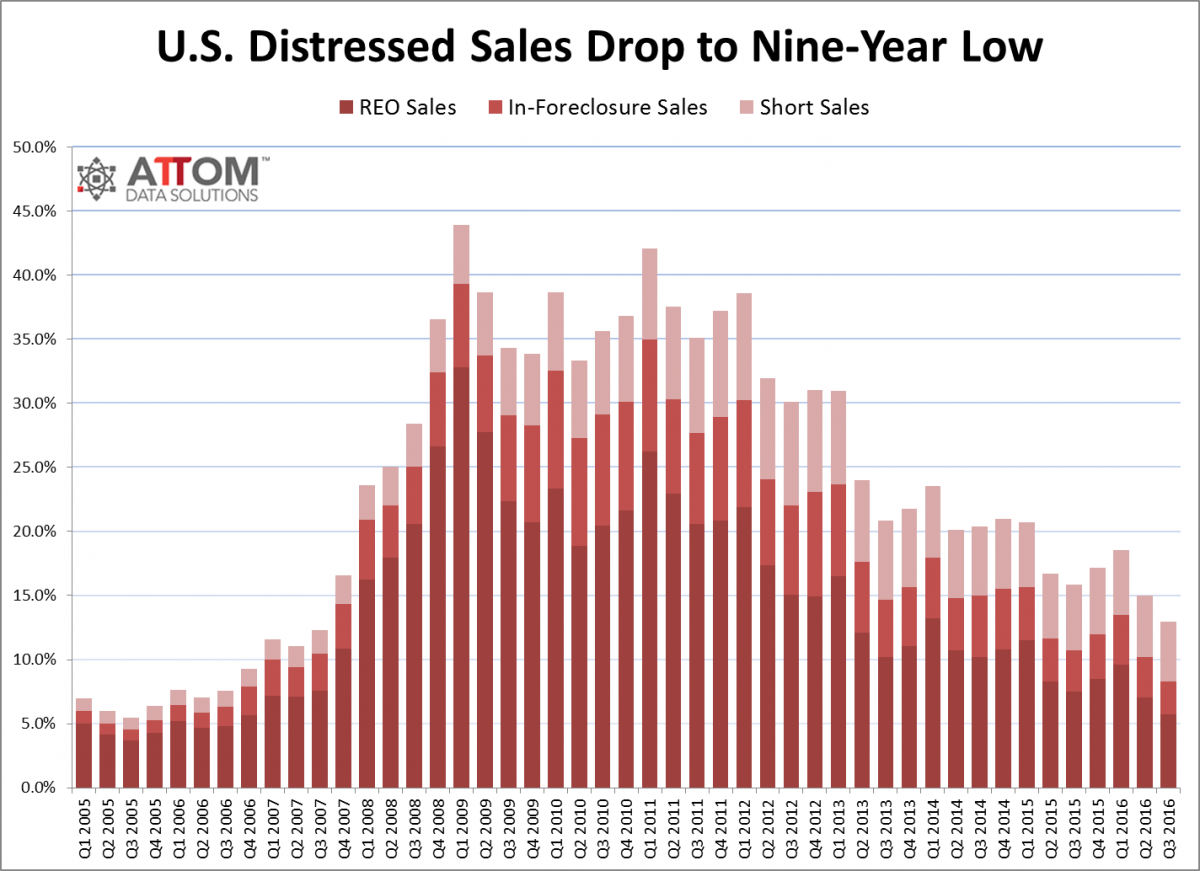

Distressed sales accounted for 12.9 percent of all single-family home and condo sales in the third quarter, down from 15 percent in the second quarter and a 15.9 percent year-over-year decline. The third quarter marked the lowest share of distressed home sales since the third quarter of 2007, when distressed sales accounted for 12.3 percent of all home sales.

Also hitting a new depth was all-cash purchases, which accounted for 25.9 percent of all single-family home and condo sales in the third quarter, a slide from 27.4 percent in the previous quarter and 29.2 percent in third quarter of Q3 2015. This marks the lowest level for this activity since the third quarter of 2007, when all-cash purchases accounted for 24.3 percent of all home sales.

“Distressed inventory for sale is virtually non-existent in many of the nation’s hottest housing markets, and when a distressed property is listed for sale in those markets it often sells quickly and at little or no discount,” said Daren Blomquist, senior vice president at ATTOM Data Solutions. “The scarcity of discounted distressed inventory is chasing away cash buyers and other bargain hunters, but it’s certainly good news for home sellers, who nationwide realized the biggest home price gains since purchase in nine years.”

On a national average, homeowners who sold their property in the third quarter pocketed an average of $43,000 above their purchase price, a 23 percent average home price gain since purchase—the highest gain since (yes, again) the third quarter of 2007. But whether that trend can continue in the near-future is unclear.

“We are seeing the average seller home price gain since purchase start to wane in some of the highest-priced markets where appreciation is beginning to cool, indicating those markets are past their prime as sellers’ markets,” Blomquist added. “Meanwhile there are still a number of buyers’ markets across the country where a high level of lingering distress and relatively weak demand from owner-occupant buyers provides investors with plenty of bargain-buying opportunities.”