CoreLogic Debuts Home Credit Index

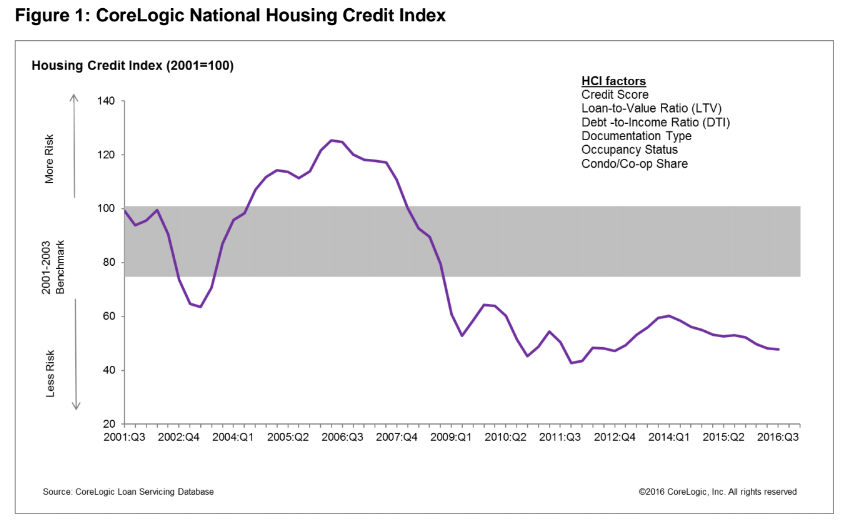

The industry may not have been clamoring for another data index, but it has one: CoreLogic has introduced a quarterly report featuring a proprietary Housing Credit Index (HCI) designed to measures variations in home mortgage credit risk attributes over time—including borrower credit score, debt-to-income ratio (DTI) and loan-to-value ratio (LTV).

For its first report, the CoreLogic HCI determine that new single-family loans had more credit risk in the third quarter than in the second quarter, while mortgages originated third quarter had a lower credit risk on a year-over-year measurement. In terms of credit risk, third quarter mortgages were among the highest-quality home loans originated since 2001.

The CoreLogic HCI also found that the average credit score for homebuyers increased from 734 in the third quarter of 2015 to 739 in this year’s third quarter, while fell from 35.7 percent to 35.4 percent and the LTV homebuyers decreased from 86.8 percent to 85.6 percent in the same period.

“The index incorporates six risk attributes, including the three C's of underwriting—credit, collateral, and capacity,” said Frank Nothaft, chief economist of CoreLogic. “Using 2001 originations as a base year, the HCI shows the significant loosening of credit running up to 2006. This was followed by a dramatic tightening of credit in response to the real estate crash and a decline in high-credit-risk applicants beginning with the Great Recession. While low down payment and high payment-to-income products are available today, borrowers generally need good credit scores to qualify. This may be a factor that has led to the drop-off in applications from those with lower credit scores during the last few years.”