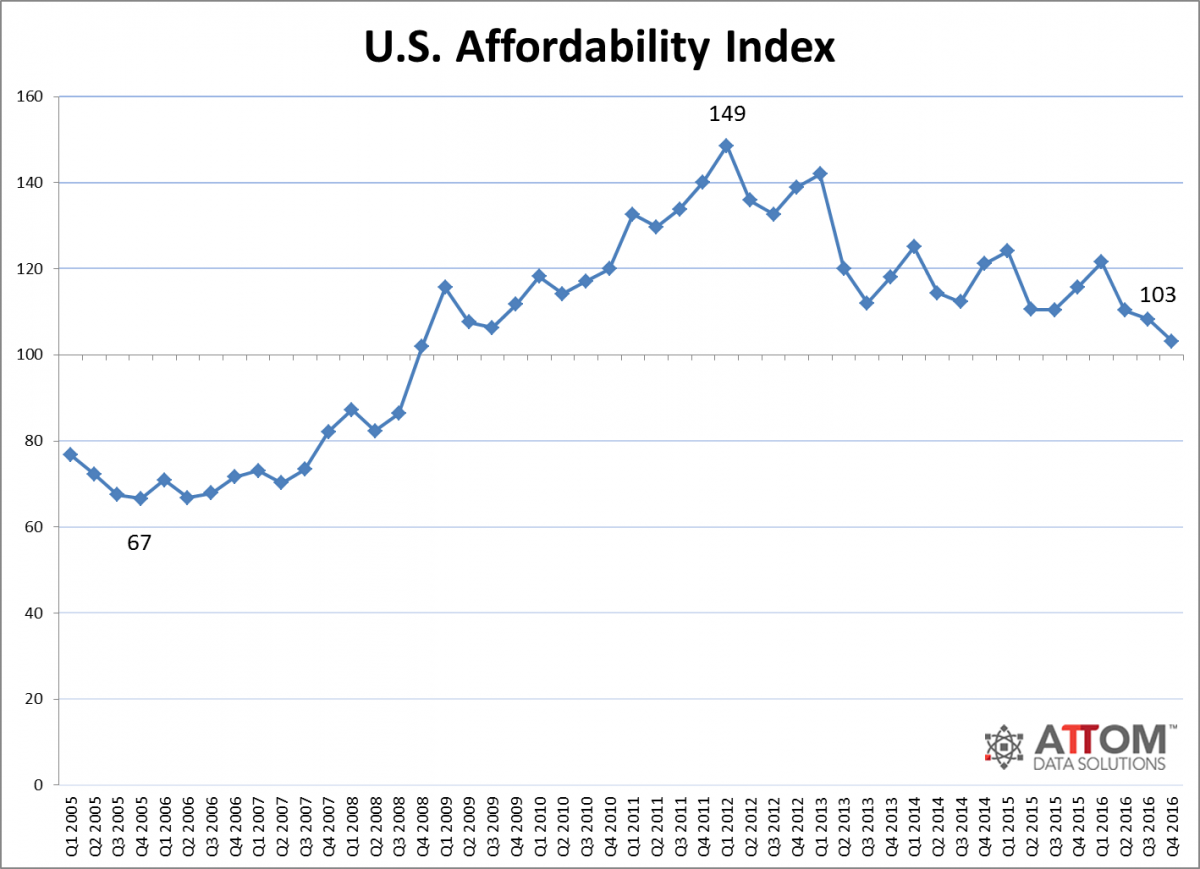

Rates on the Rise as Housing Affordability Hits Eight-Year High

ATTOM Data Solutions has reported that the national affordability index in the fourth quarter of 2016 was at its lowest level since Q4 of 2008, according to its Q4 2016 Home Affordability Index. The report also shows that 29 percent of U.S. county housing markets were less affordable than their historic affordability averages in the fourth quarter, up from 24 percent of markets in the previous quarter and up from 13 percent of markets a year ago to the highest share since Q3 2009—when 47 percent of markets were less affordable than their historic affordability averages.

The report analyzed median home prices derived from publicly recorded sales deed data collected by ATTOM Data Solutions and average wage data from the U.S. Bureau of Labor Statistics in 447 U.S. counties with a combined population of more than 184 million. The affordability index is based on the percentage of average wages needed to make monthly house payments on a median-priced home with a 30-year fixed rate mortgage (FRM) and a three percent downpayment—including property taxes and insurance. An index of 100 indicates market affordability on par with historical norms while above 100 indicates more affordable than historic norms and below 100 indicates less affordable than historic norms.

Nationally, the affordability index in the fourth quarter was 103, down from 108 in the previous quarter and down from 116 a year ago to the lowest level since Q4 2008, when the national home affordability index was 102.

“Rapid home price appreciation and tepid wage growth have combined to erode home affordability during this housing recovery, and the recent uptick in mortgage rates only accelerated that trend in the fourth quarter,” said Daren Blomquist, senior vice president at ATTOM Data Solutions. “The prospect of further interest rate hikes in 2017 will likely cause further deterioration of home affordability next year. Absent a strong resurgence in wage growth, that will put downward pressure on home price appreciation in many local markets.”

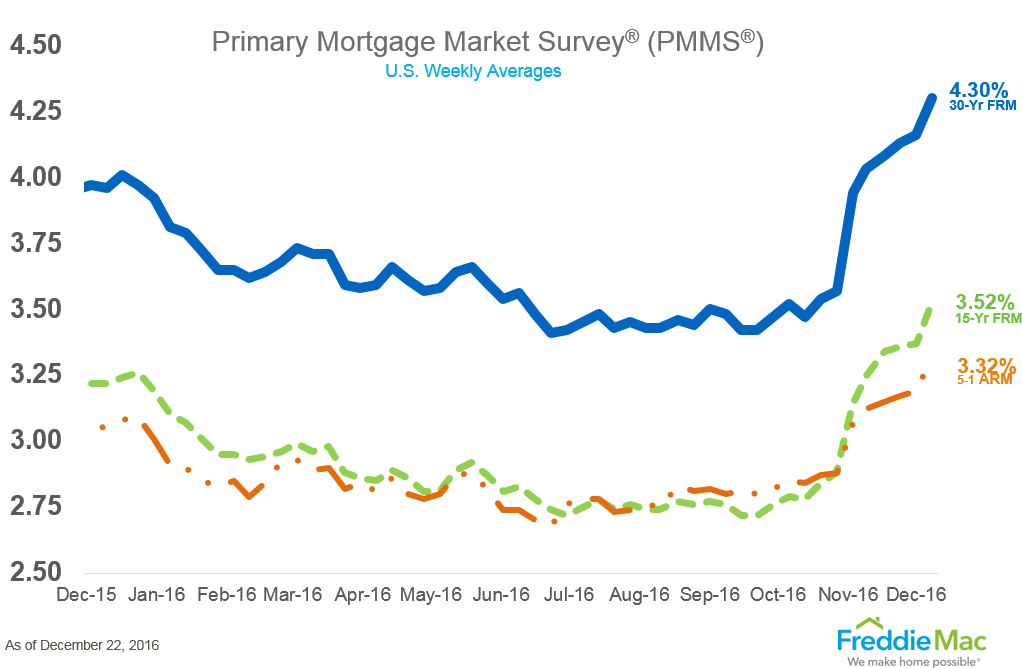

The 30-year fixed-rate mortgage (FRM) also rose this week, averaging 4.30 percent with an average 0.5 point for the week ending Dec. 22, 2016, according to Freddie Mac’s Primary Mortgage Market Survey (PMMS). This total was up from last week, when it averaged 4.16 percent. A year ago at this time, the 30-year FRM averaged 3.96 percent.

"A week after the only rate hike of 2016, the mortgage industry digested the Fed's decision and this week's survey reflects that response,” said Sean Becketti, chief economist for Freddie Mac. “Following Yellen's speech last Wednesday, the 10-year Treasury yield rose approximately 10 basis points. The 30-year mortgage rate rose 14 basis points to 4.30 percent, reaching highs we have not seen since April 2014."

Also this week, the 15-year FRM averaged 3.52 percent with an average 0.5 point, up from last week when it averaged 3.37 percent. A year ago at this time, the 15-year FRM averaged 3.22 percent. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.32 percent this week with an average 0.4 point, up from last week when it averaged 3.19 percent. A year ago, the five-year ARM averaged 3.06 percent.