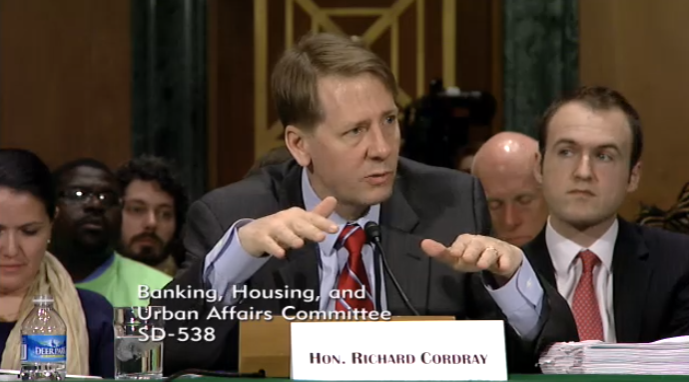

Cordray: I Am Not Quitting

The Director of the Consumer Financial Protection Bureau (CFPB) has no plans to resign once Donald Trump becomes president.

The Wall Street Journal quoted an e-mailed message from Jen Howard, a CFPB spokeswoman, regarding whether Richard Cordray will continue to serve as CFPB Director after the new administration is installed. Howard stated that Cordray “was confirmed by a bipartisan group of 66 senators to serve a term until July 2018 and has no plans to step down.” Cordray did not respond to the Wall Street Journal’s request for a direct comment.

Cordray’s leadership of the CFPB has created partisan rancor since he was first nominated by President Obama for the job in July 2011. When the Senate Republicans refused to confirm him, President Obama used a controversial recess appointment in January 2012 to place him in the director’s office; Cordray was confirmed in July 2013 when then-Majority Leader Harry Reid threatened to unilaterally change the Senate’s filibuster rule. In October, a court ruled that the power structure of the CFPB was unconstitutional and the president had the ability to fire the agency’s director—a challenge to that ruling by the CFPB is now pending the U.S. Court of Appeals for the District of Columbia Circuit, though it is not certain whether the court will rule on the case before the January 20 inauguration.