The Mortgage Godfather: Go to a Closing? Are You Crazy?

It has always been my contention that when we served our clients, we always owed our absolute fidelity, plus we must always strive to give better service than they could get from anyone else. I still believe these things and now offer some methods to achieve these goals.

My first sales manager taught me that no matter what was needed to get a loan to closing (we called it a settlement then), it was my personal responsibility to see that every single document was delivered, by me, by hand, when permitted. So, being a good student, having studied successful people, it became my habit to coddle my clients and offer to be their personal messenger when needed. My clients were and are my life blood, the source of continued business. Your last satisfied client is the first one who will always be the best source of continued business.

When you have the opportunity to meet with your client personally, take a complete and accurate mortgage application. If they forget or don't bring to the application the proper information, offer to pick up any missing documentation. When the loan is in process, offer to pick up the appraisal, the credit report, the survey, the title report, etc. Do whatever is necessary to get the loan approved. When the commitment is issued, call both the client, their attorney and the real estate person or whoever was your source of the application. When you call the client, ask when it will be convenient to meet with them to go over the commitment. It is your responsibility to help the client understand what the commitment says and will happen next. Then, you must explain what will happen at the closing. Remember, you are the most professional person in the chain of people involved in this transaction. When you are explaining the commitment, you should then go over the closing costs.

Then, the coup-de-grace … let your client know that you will go to the closing. I met with a new client last week and the subject of attending the closing came up during a conversation at the office of their attorney. This attorney handles real estate matters as his primary business, so he is familiar with the mortgage industry as it relates to the public. He asserted that he has never seen a loan officer at one of his closings. Although I was hard-pressed to accept that statement, he found out with me that it is my practice. Why would I leave it up to someone else to represent me?

Why don't most loan officers attend closings? Is it because they didn't prepare properly? Is it because they are afraid? Is it because their clients weren't properly explained the process? Is it because we don't care? Is it because most sales managers believe it is wasted time?

There is always more than one reason that anything happens. You must search yourself to find out why, but after you discuss this at your next sales meeting, try for a month to attend every closing possible.

Countless numbers of successful loan officers will tell you that one of the most productive aspects of their business day is when they go to a closing. They often look at this as the time to take a bow. This is when they get congratulated.

Many companies will tell you that attendance at the closing is a non-productive, waste of good farming time. The most successful will tell you that the loan officer who takes the time to stop at a closing is one who is in control. This is a loan officer who is not afraid. This is a person who properly serviced their client to the point that at the closing, they tell all the people "This is our loan officer, who helped us through our loan process and did everything possible to make it a pleasant experience.”

Yes, we all know how the mortgage application procedure is a difficult time for the applicant. Your responsibility does not end when you get a commitment. It extends to the time the money that you helped to obtain, passes to your client. What your client does with that money is either purchase a home, lower their interest rate, receive extra cash or some other wonderful thing. You have to go the extra mile to psychologically support your client to the last moment. You'll find yourself doing a better overall job because of it.

Do it … don't just think about it.

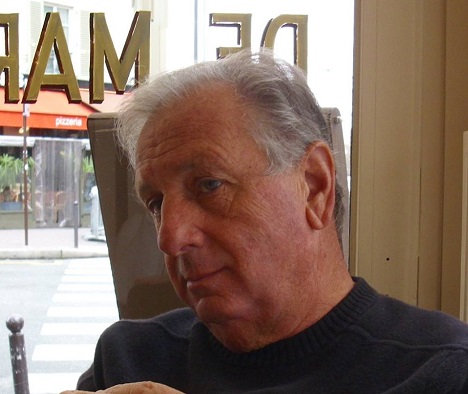

Ralph LoVuolo Sr. has more than 50 years in the mortgage Industry, with the last 30 as a coach. He is past president and founder of the New York Association of Mortgage Brokers, and long-time member of NAMB—The Association of Mortgage Professionals. He can be reached by phone at (917) 576-1230 or e-mail [email protected].

This article originally appeared in the August 2016 print edition of National Mortgage Professional Magazine.