NAR, Four Former HUD Secretaries Back Carson Nomination

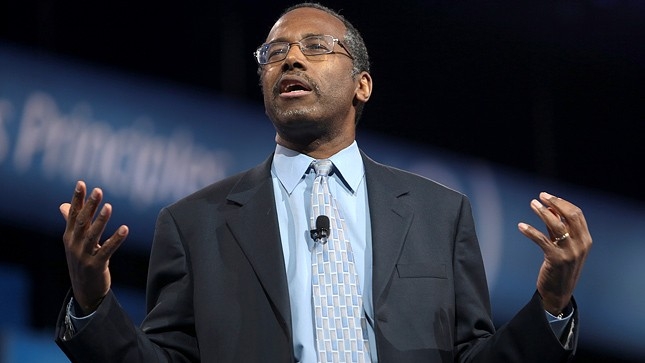

The National Association of Realtors (NAR) has become the latest trade organization to support the nomination of Dr. Ben Carson to become the next Secretary of the U.S. Department of Housing & Urban Development (HUD).

“Dr. Carson has shown a clear commitment to ensuring all Americans have access to a safe and affordable place they can call home,” said NAR President William E. Brown. “With that in mind, we’re urging members of the U.S. Senate to swiftly confirm him as Secretary of HUD. It’s no small task setting policies that support homeownership and real estate investment, and Dr. Carson is to be commended for taking on the challenge. We look forward to working with Dr. Carson in his new capacity on behalf of that important mission.”

Dr. Carson, a retired neurosurgeon who sought the 2016 Republican presidential nomination, faced a confirmation hearing before the Senate Banking Committee yesterday. His confirmation hearing included a letter of bipartisan support from four previous HUD chiefs: Henry Cisneros and Mel Martinez, who served in President Bill Clinton’s administration, and Alphonso Jackson and Steven Preston, who served under President George W. Bush, joined together to urge the confirmation of Carson’s nomination.

“The singular, common piece of advice every HUD Secretary is given is to listen,” the letter stated. “It worked to help us overcome the challenges we faced, and we know Dr. Carson will heed it as well as he works to help make HUD’s mission a reality: Creating strong, sustainable, inclusive communities and quality affordable homes for all. As Secretary, we know that Dr. Carson will learn about what works, develop new innovations, measure outcomes, and achieve real results to improve communities throughout America.”