Advertisement

More Unmarried Young Couples Buying Homes Together

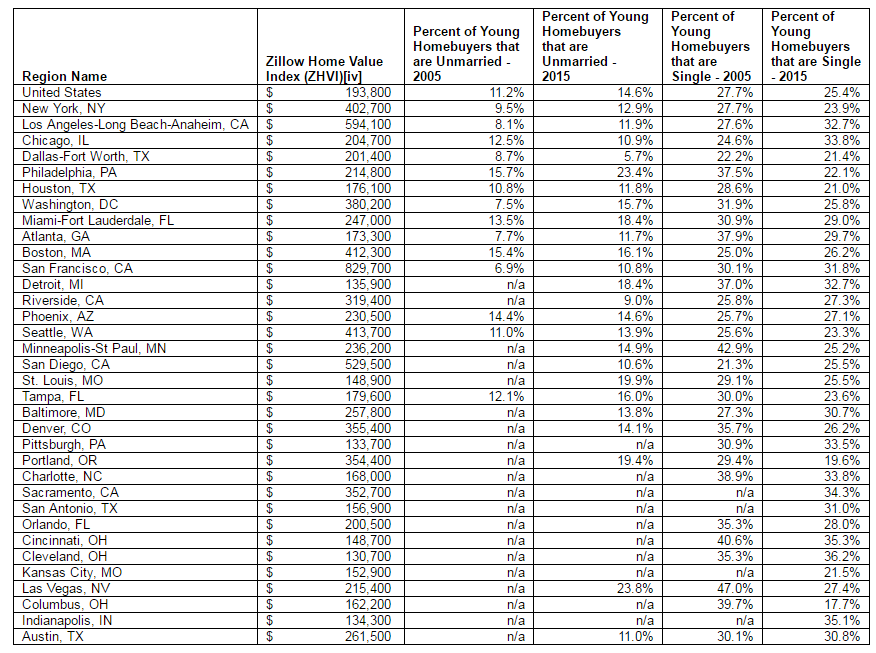

The intersection of marriage and homeownership is growing wider, as a new data study from Zillow has found almost 15 percent of all homebuyers between the ages of 24 and 35 during 2015 were unmarried couples, up from 11 percent in 2005.

In some markets, there is a greater prominence of unmarried couples buying residential property: in Washington, D.C., for example, almost 16 percent of all young homebuyers in 2015 were unmarried couples, up from 7.5 percent 10 years earlier. But while more unmarried couples are buying houses, fewer singles are entering into homeownership: roughly 25 percent of all 2015 homebuyers ages 24-35 were single, down from 28 percent in 2005.

"Buying a home is a big part of The American Dream—equally shared by millennials and Baby Boomers alike—but it's becoming extremely difficult to make it work on a single income," said Zillow Chief Economist Svenja Gudell. "Many singles looking to purchase a home on their own may not make enough money to afford or qualify for a mortgage on their dream home. That makes buying a home with a significant other even more appealing, even if marriage isn't quite part of the picture. Simply put, buying a home is much easier with two incomes. Assuming home value growth continues to outpace income growth, I imagine this trend will continue."

About the author