Advertisement

Mortgage Rates Drop, Homeownership Desire Increases

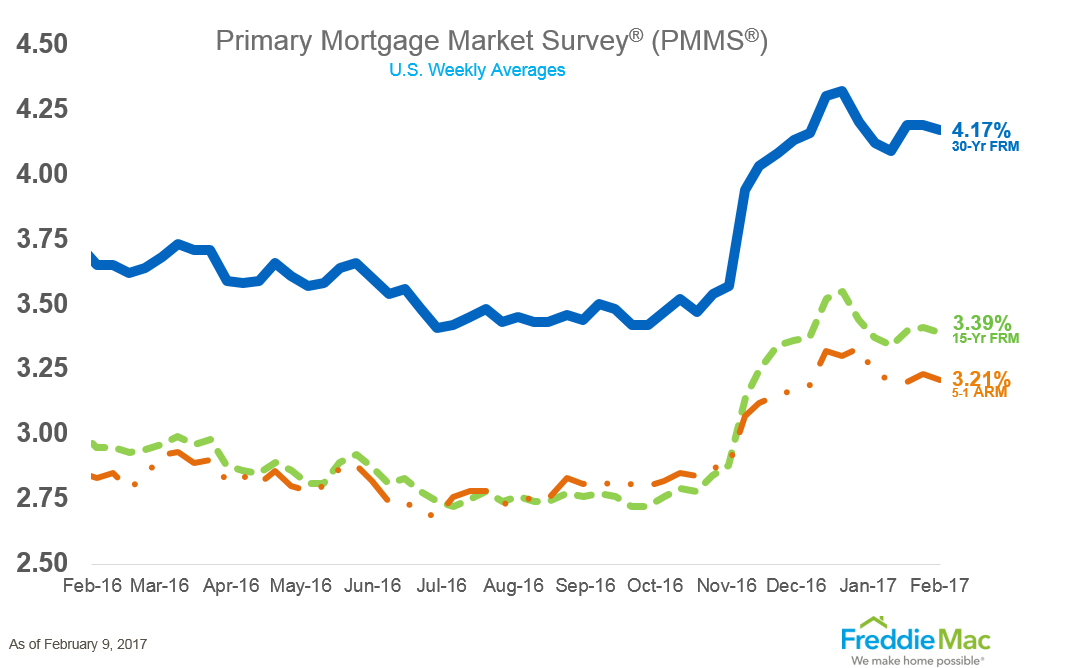

Average mortgage rates took a slight dip in the latest Freddie Mac Primary Mortgage Market Survey (PMMS).

The 30-year fixed-rate mortgage (FRM) averaged 4.17 percent for the week ending Feb. 9, down from last week when it averaged 4.19 percent. The 15-year FRM this week averaged 3.39 percent, down from last week when it averaged 3.41 percent. And the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.21 percent this week, down from last week when it averaged 3.23 percent.

“Rates are at about the same level at which they started the year and have stayed within a two-basis-point range over the past three weeks,” said Freddie Mac Chief Economist Sean Becketti. “Mixed economic releases such as Friday's jobs report and uncertainty about the Administration's fiscal policies have contributed to the holding pattern in rates."

Nonetheless, the desire to pursue homeownership has not abated. A new report from Bankrate.com determined that 59 million American adults (one in four) are considering buying a home this year. Furthermore, almost two in five minorities affirmed at least some likelihood of buying a house in 2017, more than double the percentage of white Americans who responded the same way. And 20 percent of older Millennials (ages 27-36) and Gen Xers (37-52) indicated they are very or somewhat likely to take the plunge.

“Among millennials, there's a lot of pent-up demand for home buying,” said Holden Lewis, Bankrate.com’s senior mortgage analyst. “They have been stymied by stagnant wages, student loans and a lack of available starter homes. If enough affordable homes are put on the market, we might see a surge of first-time homebuyers in their early to mid-30s.”

About the author