Advertisement

A Gloomy Wednesday in Housing Data

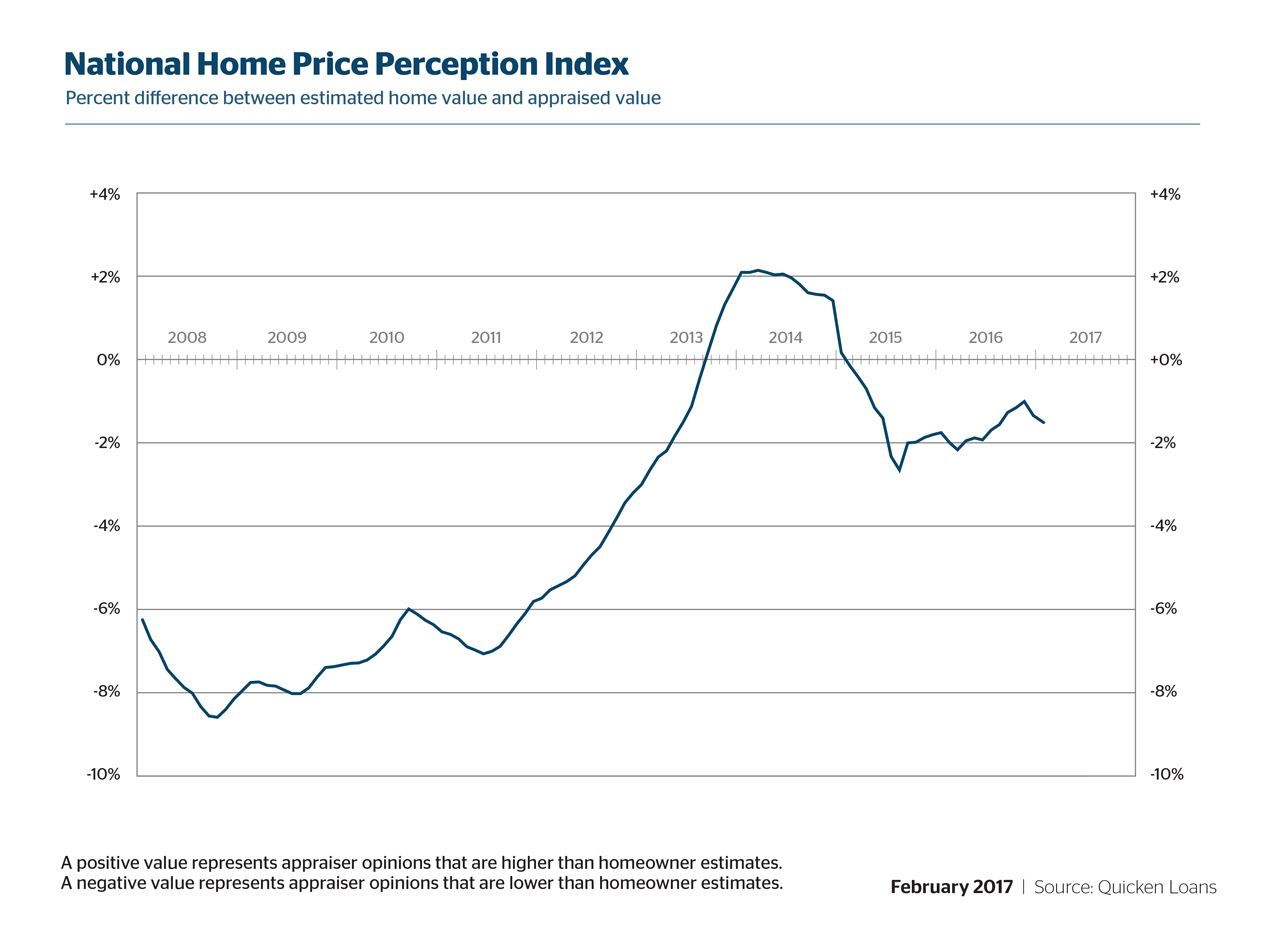

A sense of pessimism permeated today’s latest housing data, with a lower level of mortgage applications and a widening gap between homeowner estimates and appraiser opinions.

The Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending Feb. 10 found the Market Composite Index down by 3.7 percent on a seasonally adjusted basis and down by one percent on an unadjusted basis from one week earlier. The seasonally adjusted Purchase Index fell by five percent from one week earlier, but the unadjusted index saw a one percent uptick and was three percent higher than the same week one year ago. The Refinance Index took a three percent dip from the previous week while the refinance share of mortgage activity decreased to 46.9 percent of total applications—its lowest level since June 2009—from 47.9 percent the previous week.

Among the federal home loan programs, the FHA share of total applications remained unchanged at 11.9 percent from the week prior while the VA share of total applications decreased to 11.8 percent from 12.7 percent and USDA share of total applications increased to one percent from 0.9 percent.

Separately, Quicken Loans’ National Home Price Perception Index (HPPI) showed the average appraisal value was 1.47 percent below what owners expected in January. This was the second consecutive month that the HPPI declined. This two-month drop in the HPPI comes on the heels of a six month stretch where opinions between homeowner and appraiser were steadily moving closer to equilibrium. Last month’s appraisal values fell by a relatively scant 0.34 percent, Quicken Loans’ Home Value Index. But when viewed annually, appraised values increased 3.93 percent year-over-year.

“Tight inventory has been a key contributing factor to the year-over-year growth in home values,” said Quicken Loans Chief Economist Bob Walters. “This steady growth could very well lead to more availability, driving homeowners to consider cashing in on their growing equity by putting their home on the market. When this happens, it will open up new opportunities for eager buyers.”

About the author