Advertisement

Positive Equity in Homes Up 11.7 Percent

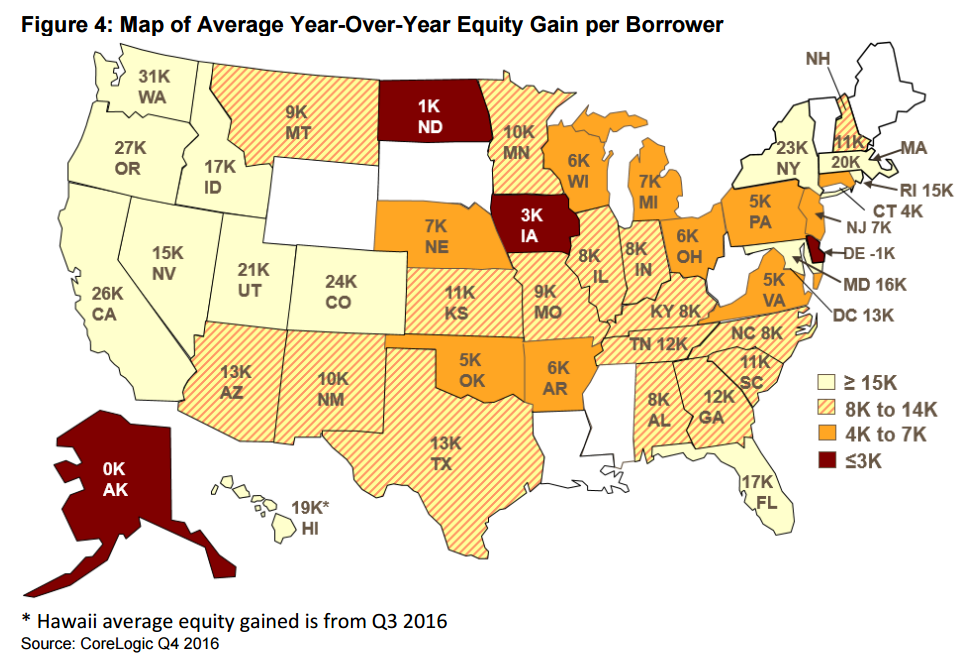

Homeowners with mortgages saw their equity increase by a total of $783 billion in 2016, a year-over-year increase of 11.7 percent, while more than one million borrowers moved out of negative equity, increasing the percentage of homeowners with positive equity to 93.8 percent of all mortgaged properties, or approximately 48 million homes.

According to data from CoreLogic, the total number of mortgaged residential properties with negative equity stood at 3.17 million during the fourth quarter of last year, or 6.2 percent of all homes with a mortgage. This is a two percent decline from the third quarter and a 25 percent drop from the fourth quarter of 2015.

The national aggregate value of negative equity was approximately $283 billion at the end of the fourth quarter, down by approximately $700 million, or 0.3 percent, from $283.7 billion in third quarter and down by approximately $26 billion, or 8.4 percent, from $308.9 billion in fourth quarter of 2015.

Texas and Hawaii were the states with the highest percentage of homes with positive equity, at 98.4 percent and 98.1 percent, respectively, while the greater San Francisco area had the highest percentage among major metro markets at 99.4 percent.

"Average home equity rose by $13,700 for U.S. homeowners during 2016," said Frank Nothaft, chief economist for CoreLogic. "The equity build-up has been supported by home-price growth and paydown of principal. The CoreLogic Home Price Index for the U.S. rose 6.3 percent over the year ending December 2016. Further, about one-fourth of all outstanding mortgages have a term of 20 years or less, which amortize more quickly than 30-year loans and contribute to faster equity accumulation."

About the author