Advertisement

Mortgage Applications Up, Valuation Questions Remain

Interest in home loans continued to grow, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending March 10.

The Market Composite Index was up by 3.1 percent on a seasonally adjusted basis and by four percent on an unadjusted basis from with the previous week. The seasonally adjusted Purchase Index increased by two percent while the unadjusted index inched up by three percent from the previous week and was six percent higher than the same week one year ago. The Refinance Index saw a four percent rise from the previous week as the refinance share of mortgage activity increased to 45.6 percent of total applications from 45.4 percent the previous week.

Among the federal programs, the FHA share of total applications decreased to 11.1 percent from 11.8 percent the week prior and the VA share of total applications decreased to 11.1 percent from 11.6 percent, while the USDA share of total applications remained unchanged at 0.9 percent.

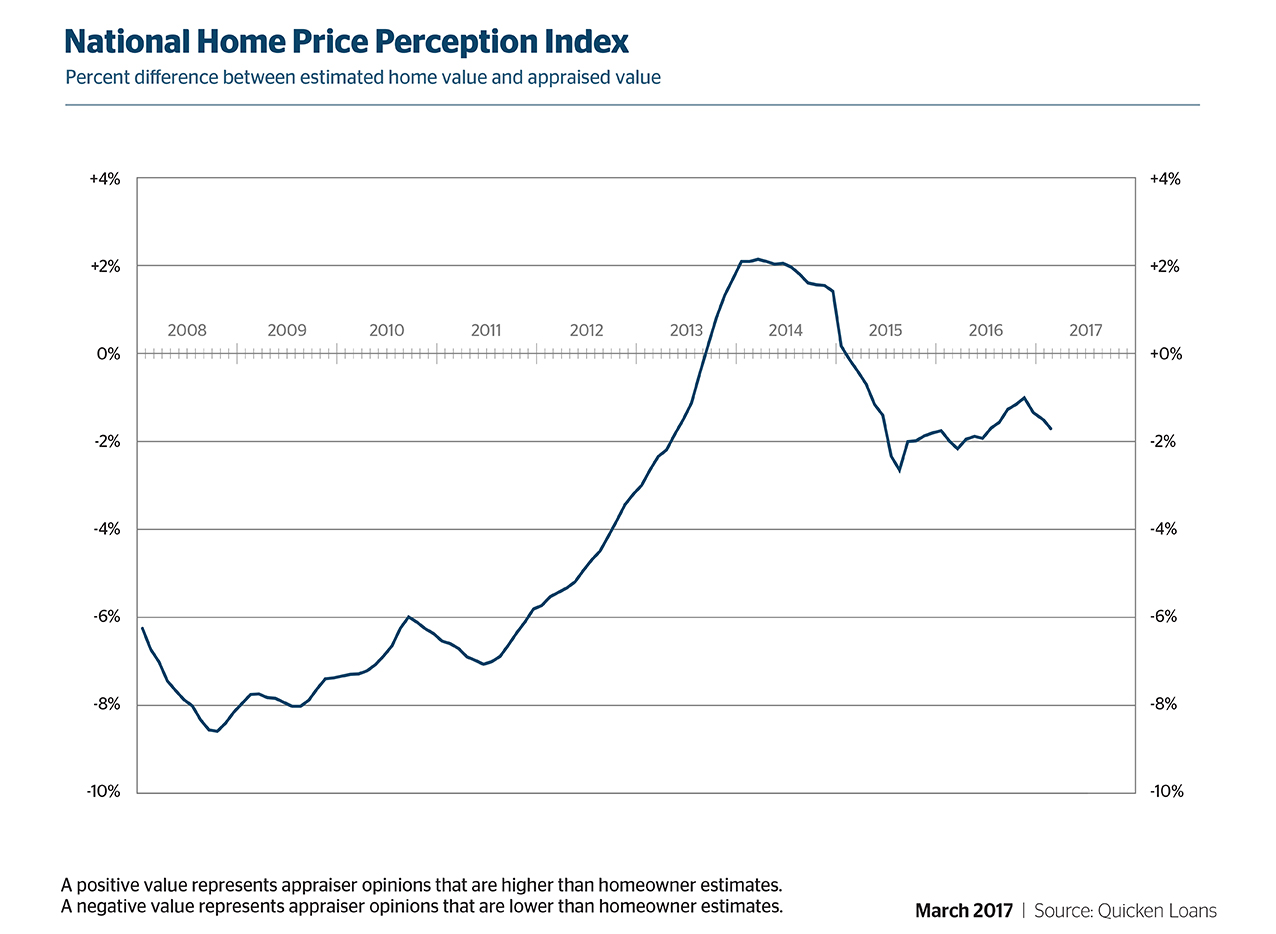

While more people are looking for homeownership opportunities, existing homeowners continue to have different opinions from appraisers on valuations. Home appraisals were an average of 1.69 percent lower than what homeowners expected in February, according to Quicken Loan’s latest National Home Price Perception Index report. Concurrently, home appraisals rose in value by an average of 0.55 percent in February from the previous month and increased 2.95 percent year-over-year, as measured by Quicken Loans’ National Home Value Index.

“Low levels of home inventory persist as the main driver of home value growth,” said Quicken Loans Vice President of Capital Markets Bill Banfield. “There are still plenty of interested buyers vying for a slim amount of homes for sale—pushing prices higher. Home values are likely to move higher in the Midwest as the spring buying season approaches, unless the number of homes available increases.”

About the author