Advertisement

Most Renters Blame Downpayment Woes for Not Becoming Homeowners

Nearly 70 percent of renters in the nation’s 20 largest metro areas complain that coming up with funds for a downpayment is the main reason they are not pursuing homeownership.

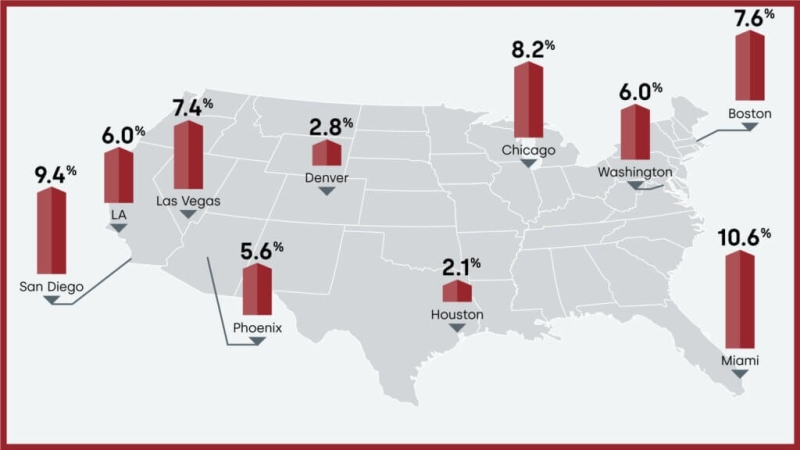

According to a new Zillow survey, nearly half of renters said debt and qualifying for a mortgage were their main obstacles for moving to homeownership, while nearly 40 percent cited job security as keeping them from buying a home. But saving for a downpayment was particularly difficult in some of the most expensive rental markets, most notably California’s San Jose, San Diego and Los Angeles metro areas. While a 20 percent downpayment on a typical home costs more than two-thirds of the national median annual household income, in some of the pricier markets it can involve more than 180 percent of the average annual income.

But that is not to say that renting is a cost-effective alternative. Zillow noted that rents are at record highs, and in some areas these costs gobble up almost 50 percent of the median income. Nonetheless, 63 percent of renters surveyed by Zillow felt confident that would eventually become homeowners, with 25 percent planning on buying in the next three to five years.

"With home values close to record highs, it's no surprise renters are concerned about coming up with enough money to buy a home," said Zillow Chief Economist Svenja Gudell. "Rising rents are also a factor—it's extremely difficult to save when you're paying record-high rents. While it is possible to put down as little as three percent on a home, the trade-off is a higher interest rate and costly private mortgage insurance, a financial tradeoff that may make sense for some buyers."

About the author