Advertisement

Ker-plop! 30-Year Fixed Rate Mortgage at New Low

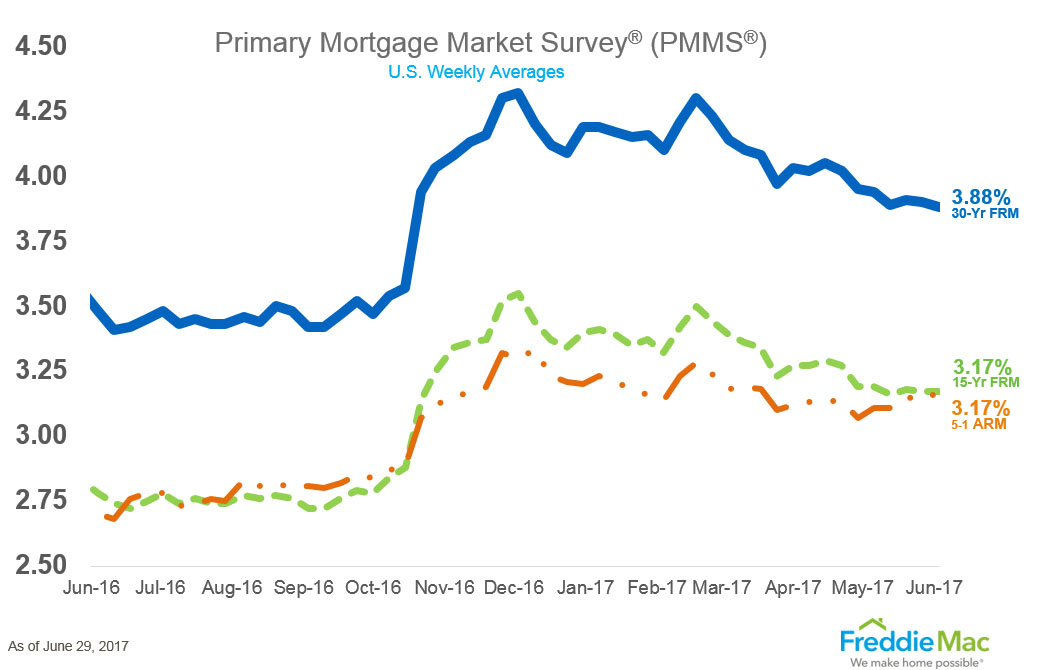

The 30-year fixed mortgage rate hit a new low for 2017, according to the latest Freddie Mac Primary Mortgage Market Survey (PMMS). The 30-year fixed-rate mortgage (FRM) averaged 3.88 percent, down from last week when it averaged 3.90 percent. Nonetheless, it is higher than the 3.48 percent average from one year ago.

Freddie Mac also reported the 15-year FRM this week averaged 3.17 percent, unchanged from last week and higher than the 2.78 percent average last year. And the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.17 percent, up from last week when it averaged 3.14 percent; the product averaged 2.70 percent one year ago.

Sean Becketti, chief economist at Freddie Mac, noted that “the majority of our survey was conducted prior to Tuesday's sell-off in the bond market which drove Treasury yields higher. Mortgage rates may increase in next week's survey if Treasury yields continue to rise.”

Separately, the Federal Housing Finance Agency (FHFA) reported that the National Average Contract Mortgage Rate for the Purchase of Previously Occupied Homes by Combined Lenders Index was 3.87 percent for loans closed in late May, down from 3.97 percent in April. The average interest rate on all mortgage loans was 3.90 percent, down from 3.98 in April. And the average interest rate on conventional, 30-year, FRMs of $424,100 or less was 3.97 percent, down from 4.04 in April.

The FHFA also reported that the effective interest rate on all mortgage loans was 4.02 percent in May, down from 4.10 in April. But the average loan amount for all loans was $315,500 in May, up $3,900 from $311,600 in April.

About the author