Advertisement

Home Affordability Level at Nine-Year Low

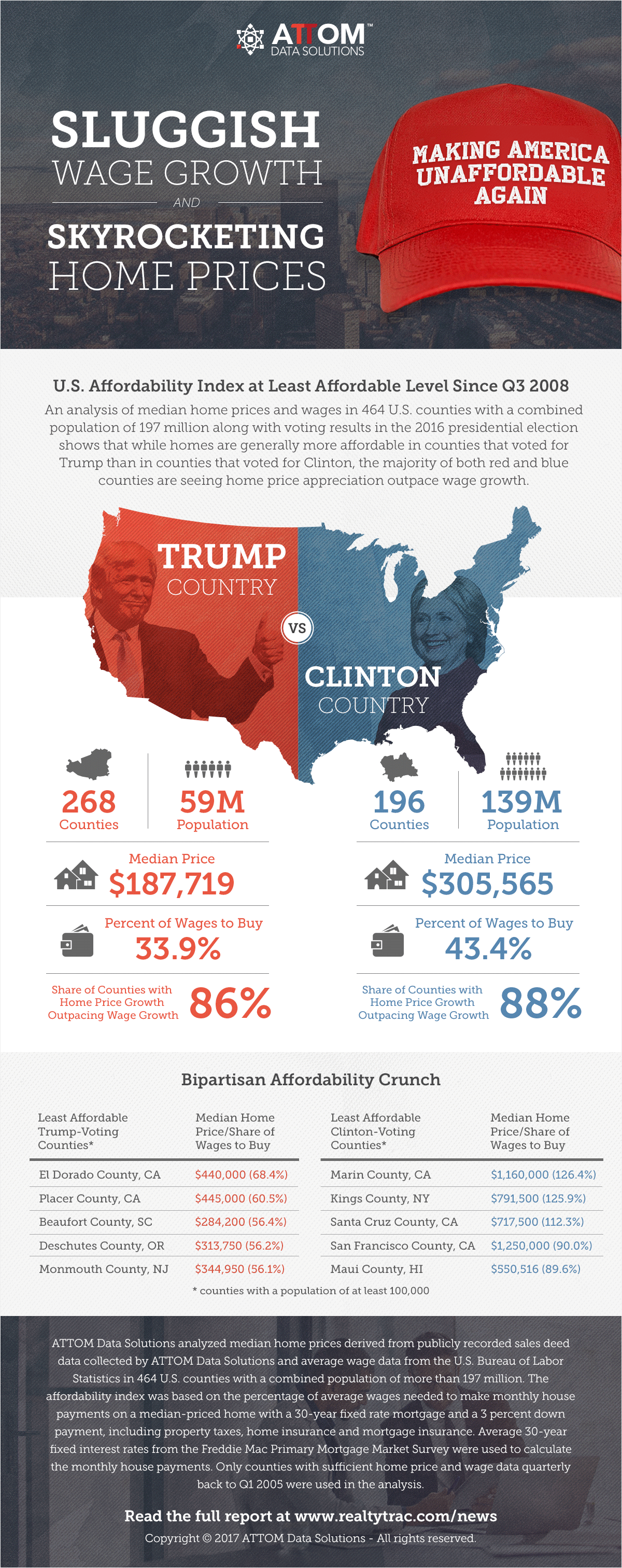

The median home price of $253,000 recorded in the second quarter was at the least affordable level in nine years, according to new statistics from ATTOM Data Solutions.

In its new study, ATTOM Data Solutions found its proprietary national home affordability index was 100 in the second quarter, the lowest national affordability index since the third quarter of 2008, when the index was 86. The company added that 210 of 464 U.S. counties analyzed for the index were less affordable than their historic affordability norms in the second quarter—the highest share of markets less affordable than their historic norms since the fourth quarter of 2009.

Median home prices in the second quarter grew at a faster annual pace than average weekly wages in 403 of the 464 counties analyzed in the report. Average wage earners would need to spend more than 43 percent of their income—the maximum debt-to-income ratio allowed for a “qualified mortgage” under guidelines from the Consumer Financial Protection Bureau—to buy a median-priced home in 144 of the 464 counties analyzed for the report.

“While home price appreciation in the second quarter accelerated to the fastest pace in more than three years, wage growth turned negative, posting the biggest year-over-year decrease in five years in the fourth quarter of 2016—the most recent average weekly wage data available,” said Daren Blomquist, senior vice president at ATTOM Data Solutions. “That combination of accelerating home price growth and slowing wage growth, along with mortgage interest rates that are up nearly 50 basis points from a year ago, eroded home affordability nationwide to the lowest level in nearly nine years, and pushed the highest share of markets beyond the threshold of normal affordability in nearly eight years.”

About the author