Advertisement

Thirty-Year Mortgage Rate Shoots Skyward

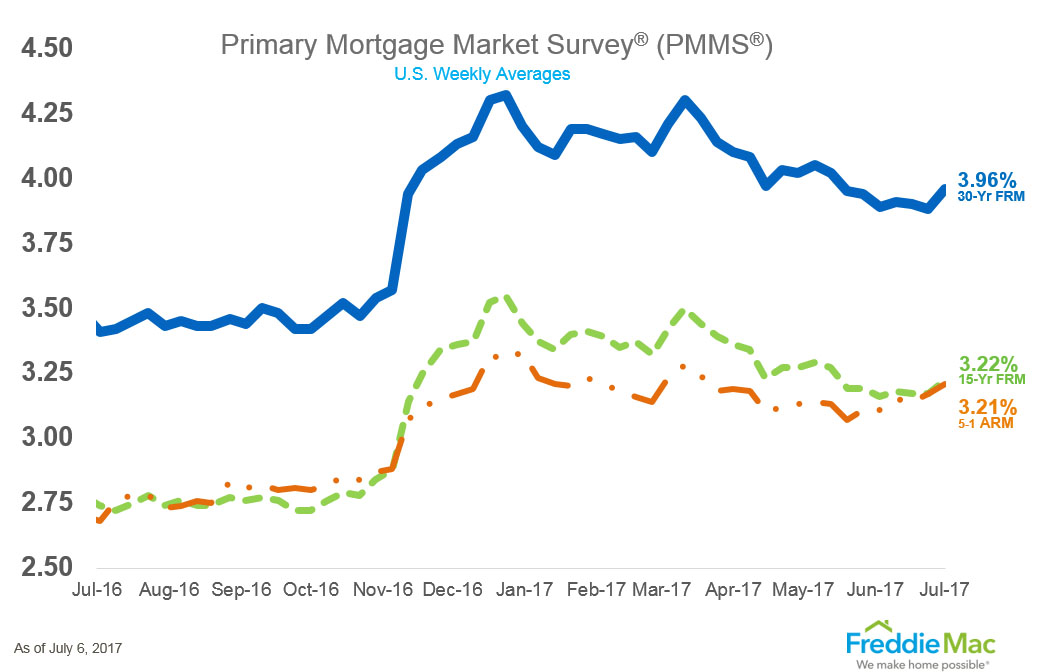

After what felt like an extended period of stagnation, the 30-year mortgage rate abruptly took a healthy upward swing, according to the latest data from Freddie Mac.

The 30-year fixed-rate mortgage (FRM) averaged 3.96 percent for the week ending July 6, up from last week when it averaged 3.88 percent. A year ago at this time, the 30-year FRM averaged 3.41 percent.

Also on the rise was the 15-year FRM, which averaged 3.22 percent this week, up from last week when it averaged 3.17 percent. A year ago at this time, the 15-year FRM averaged 2.74 percent. And the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.21 percent this week, up from last week when it averaged 3.17 percent. A year ago at this time, the five-year ARM averaged 2.68 percent.

About the author