Advertisement

Redfin: Home Prices Hit New High

Home prices in June increased by 7.3 percent to a median sale price of $298,000, according to new data from Redfin. Last month’s national median sale price was the highest that Redfin recorded since it began tracking the market in 2010. Furthermore, 26.6 percent of homes sold above their list price, the highest percentage Redfin has recorded.

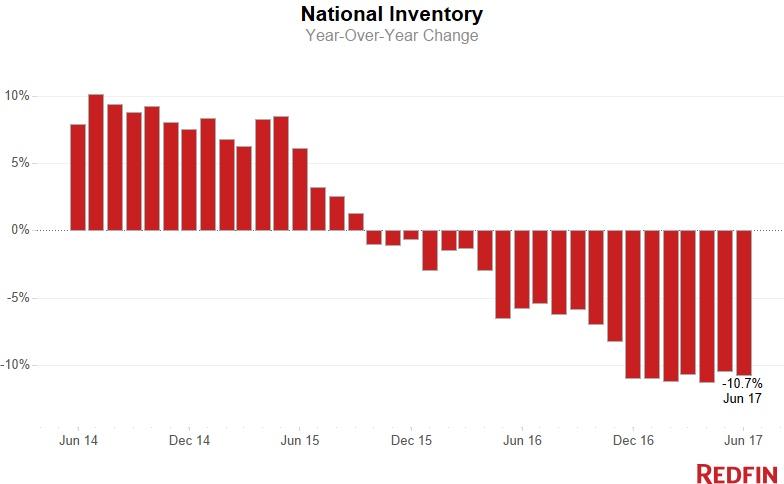

Home sales were up 1.9 percent year-over-year in June, but the number of homes for sale fell 10.7 percent, resulting in a 2.5 months’ supply—the lowest since 2010. The typical home that sold in June went under contract in 36 days, one day faster than in May and a new record; homes for sale in Denver, Portland and Seattle were snatched up, on average, in seven days.

“This market is unlike any we’ve ever seen before,” said Redfin Chief Economist Nela Richardson. “Month after month, new records are set for the pace at which homes are going under contract. Demand continues to swell while supply troughs. For buyers competing in this market, it’s survival of the fittest. The strongest offers that are most likely to close quickly and smoothly rise to the top of the pile.”

About the author