Advertisement

Existing-Home Sales Drop, But Home Prices Spike

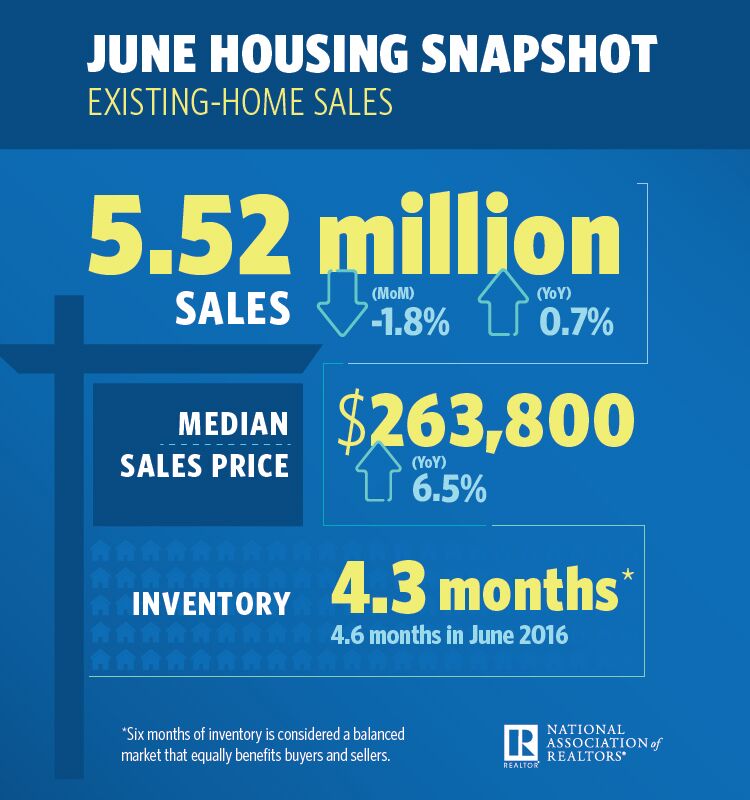

Total existing-home sales declined by 1.8 percent in June to a seasonally adjusted annual rate of 5.52 million from 5.62 million in May, according to new data from the National Association of Realtors (NAR). Sales were up 0.7 percent from June 2016, marking the second lowest year-over-year uptick of 2017.

Sales may have been stagnant, but prices were anything but: The median existing-home price for all housing types in June was $263,800, up 6.5 percent from $247,600 on year ago). Last month’s median sales price surpasses May as the new peak and is the 64th straight month of year-over-year gains.

Total housing inventory at the end of June fell by 0.5 percent to 1.96 million existing homes available for sale. June’s inventory is 7.1 percent lower than a year ago (2.11 million) and has fallen year-over-year for 25 consecutive months. Unsold inventory is at a 4.3-month supply at the current sales pace, which is down from 4.6 months a year ago.

Also falling was the percentage of first-time buyers: 32 percent of sales in June went to new homeowners, down from 33 percent both in May and a year ago.

“It’s shaping up to be another year of below average sales to first-time buyers despite a healthy economy that continues to create jobs,” said NAR Chief Economist Lawrence Yun. “Worsening supply and affordability conditions in many markets have unfortunately put a temporary hold on many aspiring buyers’ dreams of owning a home this year.”

About the author