Advertisement

Survey Finds 20 Percent of Millennials Are Homeowners

How heavy is the student loan debt burden on Millennial homeownership?

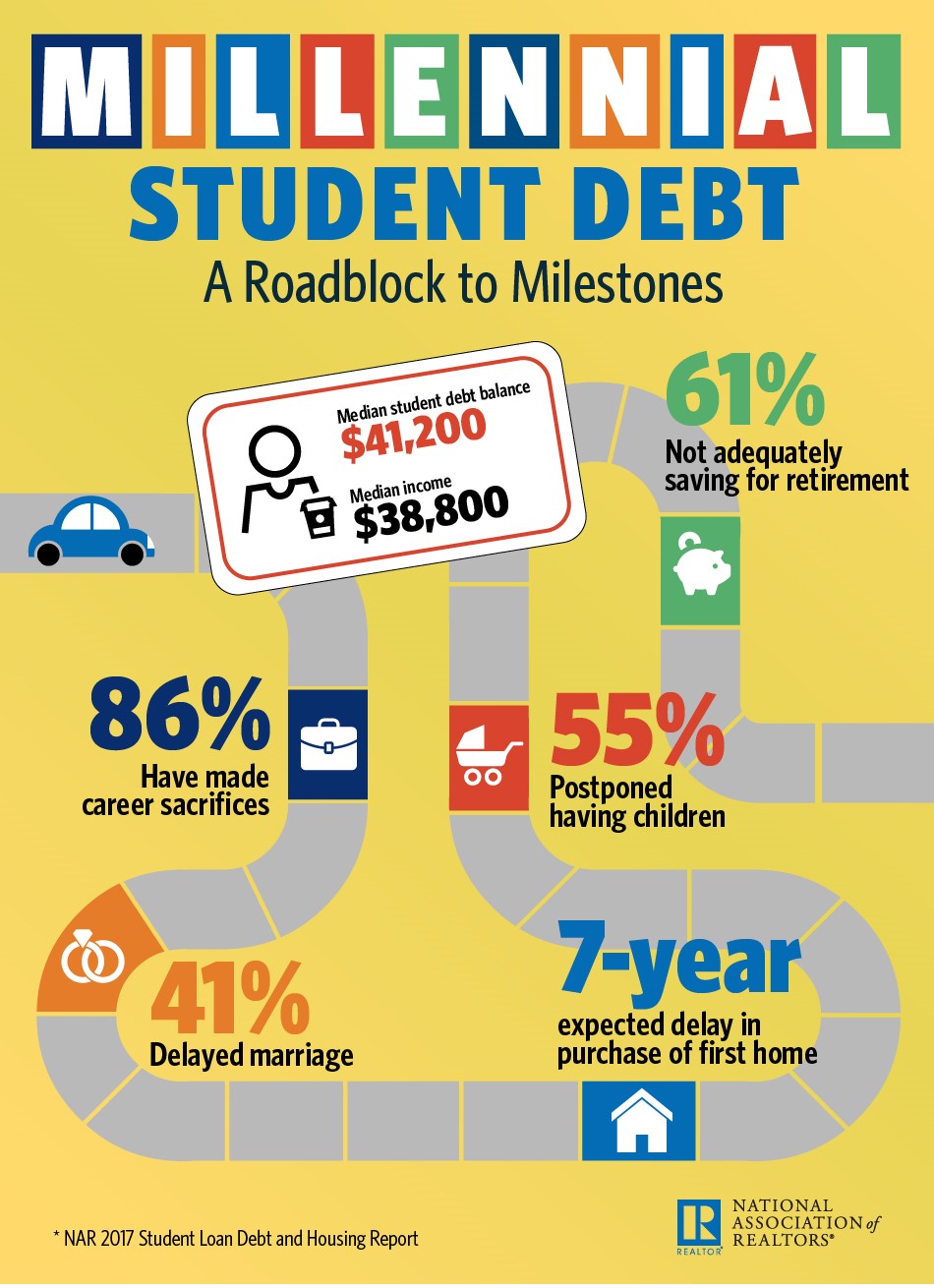

A new survey by the National Association of Realtors (NAR) and the non-profit American Student Assistance has found only 20 percent of Millennial respondents own a home while carrying a student debt load ($41,200) greater than their annual income ($38,800).

As for the 80 percent of Millennials in the survey who said they do not own a home, 83 percent stated their student loan debt has hampered their attempt at homebuying. Eight-four percent of these Millennials expect to postpone buying by at least three years. And student loan debt is also disrupting their attempts to build the foundation for retirement savings: 61 percent of respondents at times have not been able to make a contribution to their retirement, while 32 percent said they were able to occasionally contribute a reduced amount to their retirement savings.

“The tens of thousands of dollars many millennials needed to borrow to earn a college degree have come at a financial and emotional cost that’s influencing Millennials’ housing choices and other major life decisions,” said Lawrence Yun, NAR Chief Economist. “Sales to first-time buyers have been underwhelming for several years now, and this survey indicates student debt is a big part of the blame. Even a large majority of older Millennials and those with higher incomes say they’re being forced to delay homeownership because they can’t save for a downpayment and don’t feel financially secure enough to buy.”

The survey was conducted in April and involved input from 2,203 student loan borrowers between the ages of 22 to 35.

About the author