Advertisement

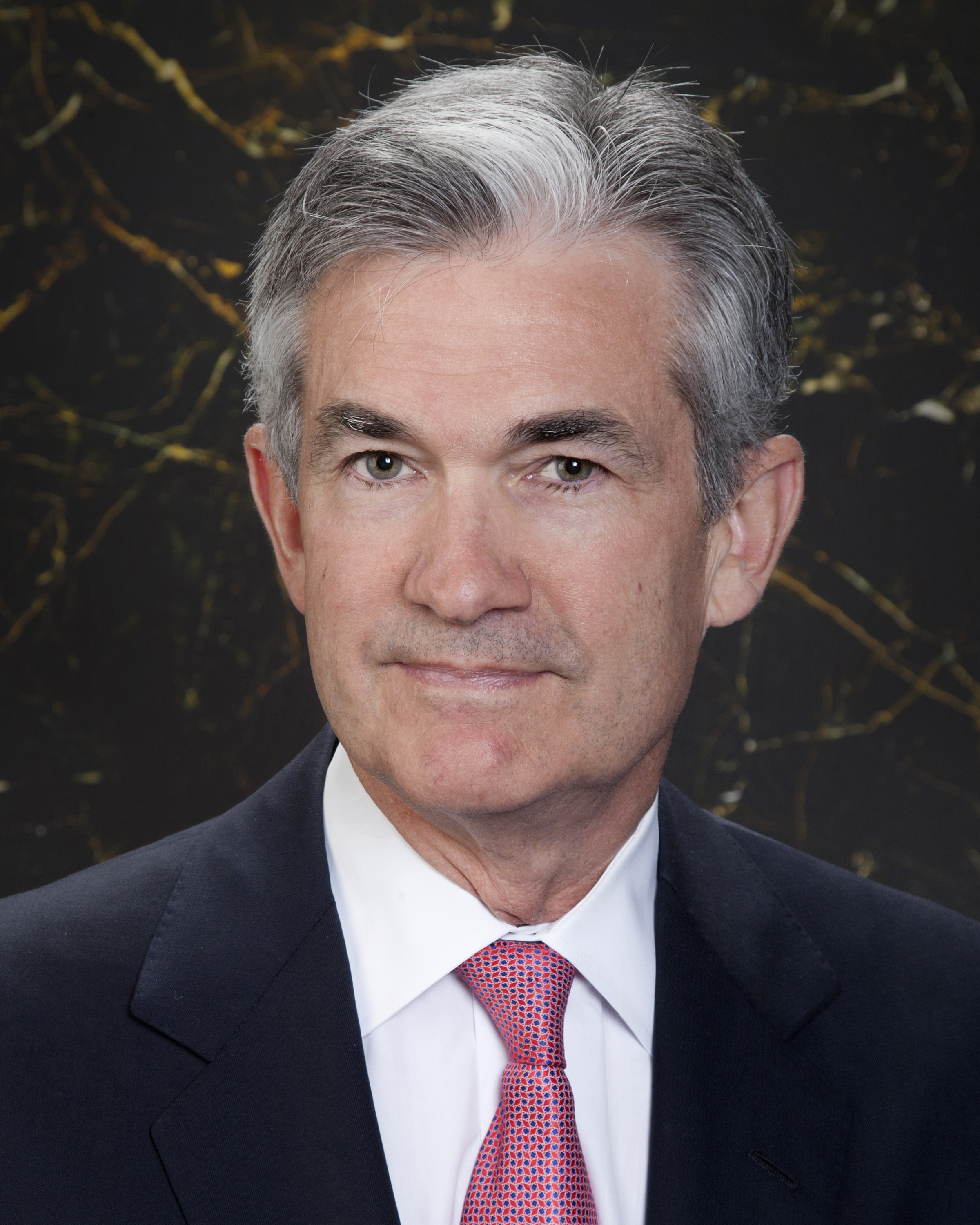

Jerome Powell Nominated as Next Fed Chairman

President Donald Trump has nominated Federal Reserve Governor Jerome Powell as the next Chairman of the U.S. central bank.

President Donald Trump has nominated Federal Reserve Governor Jerome Powell as the next Chairman of the U.S. central bank.Speaking this afternoon in a press conference, the President declared, “There are few more important positions than this.” He also praised Powell as “smart” and a “consensus builder,” adding that Powell’s five years on the Fed Board “earned him admiration and respect from his colleagues.”

The 64-year-old Powell will replace Fed Chairwoman Janet Yellen, whose term expires in February. President Trump’s decision not to nominate Yellen for a second term breaks a longstanding tradition of a president reappointing a Fed chairperson whose initial term was set by the preceding administration. Powell’s nomination requires Senate confirmation.

Powell, a Republican, was nominated to the Fed’s board in 2012 by President Barack Obama, which marked the first time that a President nominated a member of the opposition party for a central bank governorship position since 1988. Before joining the Fed, Powell was a visiting scholar at the Bipartisan Policy Center. He previously worked in the financial services sector, where he was a Managing Partner of the Global Environment Fund and founder of Severn Capital Partners.

"NAMB applauds the nomination of Jerome Powell to lead the Federal Reserve Board," said John G. Stevens, CRMS, President of NAMB. "His previous experience will serve him well in this position. We hope the Senate will move quickly to confirm Mr. Powell. NAMB looks forward to working with him, and others in the Administration to address the overregulation of the housing industry and replace it with sensible changes that protect consumers in the process. It is our hope that he continues an accommodative interest rate environment in order to ensure the economy keeps growing."

About the author