Advertisement

More Single-Family Homes Positioned as Rentals

The number of single-family homes that used as rental properties increased by 5 million between 2006 and early 2017, according to new data by Zillow. As a result of this shift toward renting out single-family houses, approximately 270,000 fewer homes are being sold each year compared to 2006, or about five percent of the homes that would sell in a typical year.

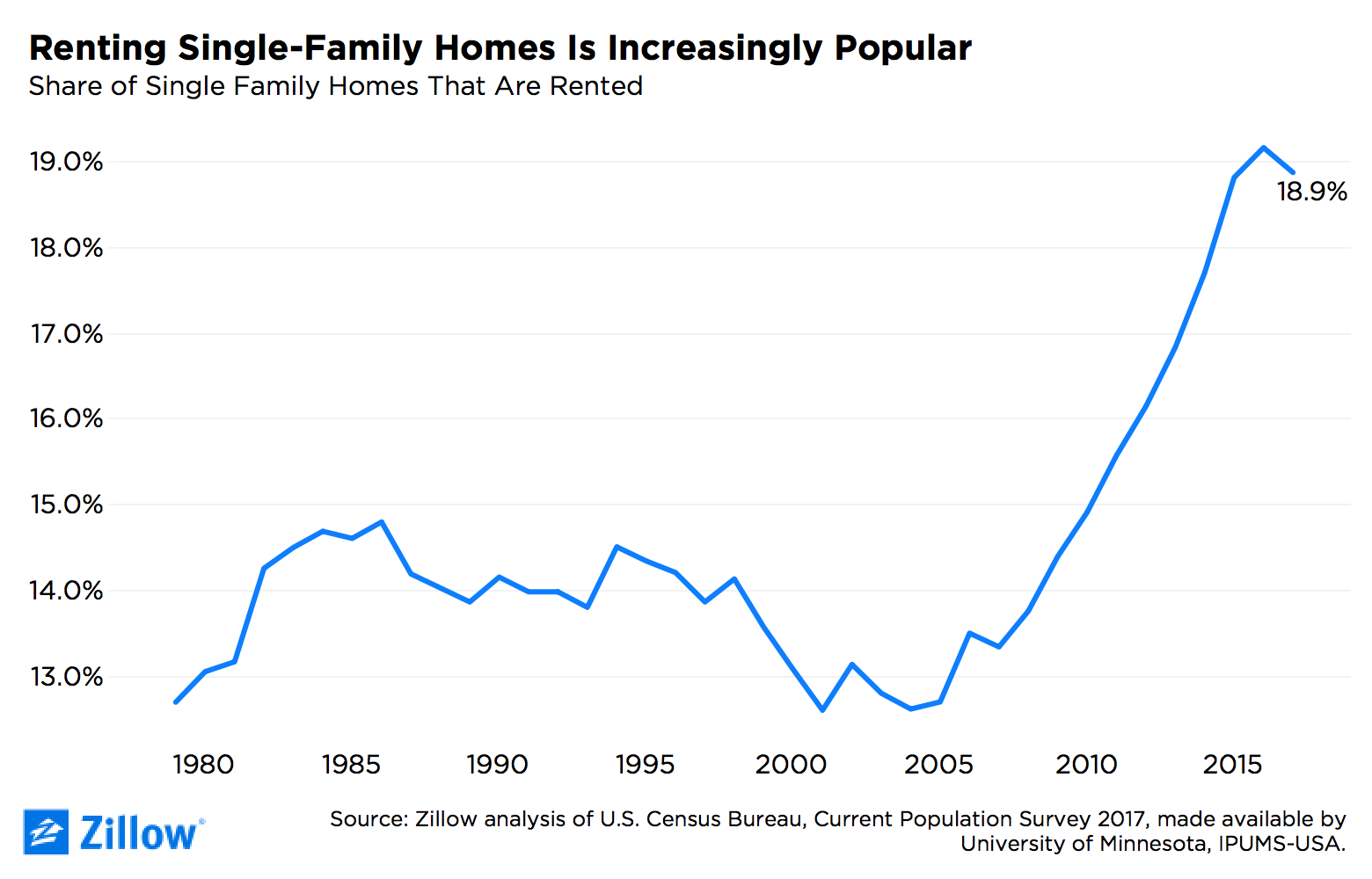

The share of single-family homes being rented out increased from about 13 percent in 2007 to a high of 19.2 percent in 2016. Forty-five percent of renters would like to rent this type of property, but only 28 percent can actually find one.

Complicating matters were the types of home being rented. Zillow determined that roughly 120,000 of these lost sales were among the most affordable homes that are often sought by first-time buyers. Nearly 40 percent of rented single-family homes bought since 2012 are among the most affordable, compared to 34 percent of single-family rental homes that were bought before the housing market crash. On a national measurement, 37 percent of rented single-family homes are among the least valuable in their housing markets.

"For the past 10 years, the number of single-family homes that are rented has grown steadily and remains near the highest levels ever recorded," said Zillow senior economist Aaron Terrazas. "The combination of foreclosures and growing rental demand following the housing crash was an attractive opportunity for investors—large and small—who were able to buy foreclosed homes and use them to meet the rental demand. At the same time, many long-time owners have opted to hold onto their homes as rentals even after they decide to move somewhere else. With such a large portion of single-family homes being rented out, and with new homes being built more slowly than the market needs, home values will continue to rise, particularly among the most affordable homes with the highest demand."

About the author