Advertisement

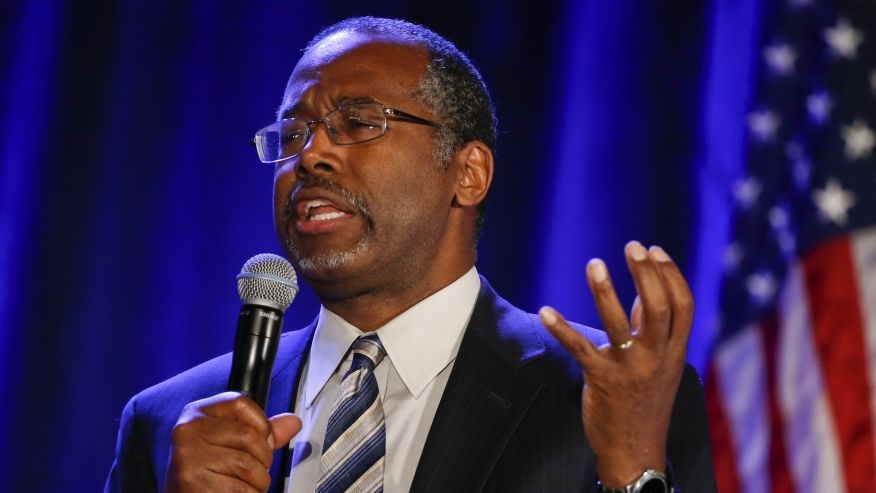

Carson Calls for Improved HUD Checks and Balances

U.S. Department of Housing & Urban Development (HUD) Secretary Ben Carson has announced new measures to protect the financial integrity of the Department and correct lax internal processes and controls. Secretary Carson directed HUD’s newly appointed Chief Financial Officer Irving Dennis to design and implement a transformation plan and lead an internal taskforce to combat waste, fraud and abuse.

“We simply need to do better,” said Carson. “An updated system of internal controls will provide our agency with greater certainty that the dollars we spend are spent in a manner that satisfies all laws and regulations, and most importantly, the American people. We will approach this as any business would by increasing transparency and accountability. In the end, we will also support a culture that respects the fact that HUD funds belong to the public.”

As a former partner at the internationally-recognized accounting firm Ernst & Young, Dennis will institute new processes and controls, empower employees, and strengthen compliance and enforcement-related functions at HUD.

“I’m excited to apply a business acumen to a task that is necessary for us as an Agency,” said Dennis. “These new internal controls and management practices must be embedded into our organization to help prevent misuse and misappropriation of assets. The goal is to create more robust processes and systems of checks and balances to ensure our expenditures not only meet all of our requirements but pass a common sense ‘smell test.’”

HUD’s new plan will consist of:

►Agencywide Governance: Implementing a Department-wide governance structure that allows for more oversight, transparency, monitoring and accountability.

►Finance Transformation: Developing a plan to restore discipline and accountability in the financial and reporting systems across the Agency.

►Grant Modernization: Developing a holistic grant modernization plan to improve grant processes and reporting, including improved IT systems.

►Process Improvement: Promoting a HUD culture focused on documented and repeatable process with a focus on transparency and cost reasonableness.

As part of this effort, HUD’s Office of the CFO, with support from the Agency’s Office of the General Counsel, are currently reviewing processes to ensure HUD is within all guidelines and utilizing resources effectively.

►Finance Transformation: Developing a plan to restore discipline and accountability in the financial and reporting systems across the Agency.

►Grant Modernization: Developing a holistic grant modernization plan to improve grant processes and reporting, including improved IT systems.

►Process Improvement: Promoting a HUD culture focused on documented and repeatable process with a focus on transparency and cost reasonableness.

As part of this effort, HUD’s Office of the CFO, with support from the Agency’s Office of the General Counsel, are currently reviewing processes to ensure HUD is within all guidelines and utilizing resources effectively.

About the author