Advertisement

Home Prices Up for 24th Consecutive Month

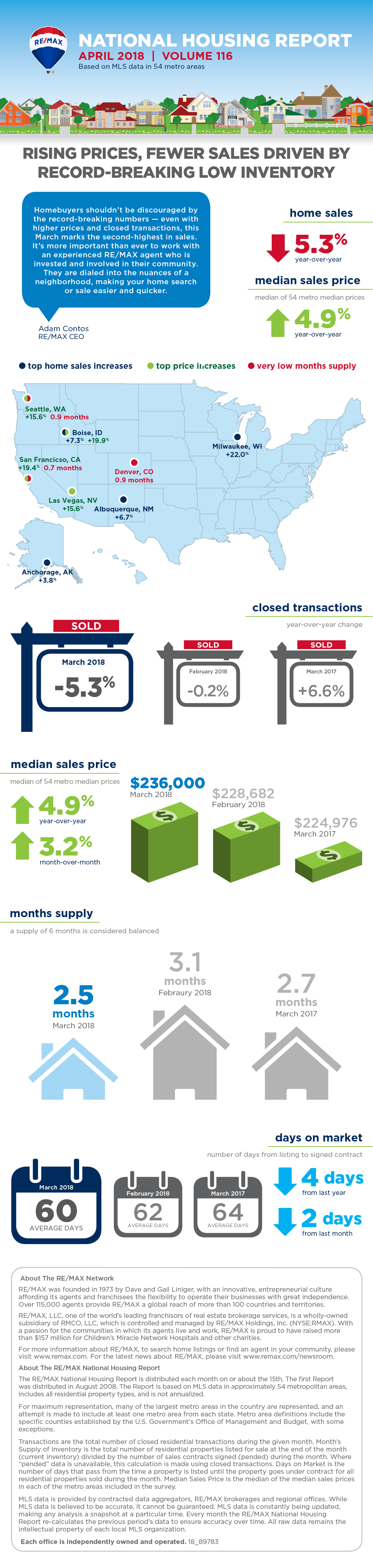

Home prices climbed for the 24th consecutive month in March while home sales fell for a fourth consecutive month, according to the latest RE/MAX National Housing Report.

In the 54 metro areas surveyed by RE/MAX last month, the overall average number of home sales increased 36.6 percent from February but fell 5.3 percent from one year earlier. Only nine of the 54 metro areas recorded year-over-year sales increases, most notably a 22 percent spike in Milwaukee.

The median sales prices for March was $236,000, up 3.2 percent from February and up 4.9 percent from March 2017. Twelve metro areas experienced year-over-year price hikes by double-digit percentages, with the greatest activity seen in Boise, Idaho (up 19.9 percent) and San Francisco (up 19.4 Percent), with four metro areas feeling a year-over-year decrease in the median sales price, most notably Anchorage with a 3.4 percent drop.

The average number of days on the market for homes sold in March was 60, down two days from the previous month and down four days from one year earlier. The number of homes for sale last month was down by 0.5 percent from February and was down by 14.7 percent from March 2017. The supply of inventory hit 2.5 months in March, down from 3.1 months in February and 2.7 months in March 2017 at 2.7, with the lowest inventory supplies in San Francisco (0.7 months) and Denver and Seattle (both at 0.9 months).

“Homebuyers shouldn’t be discouraged by the record-breaking numbers—even with higher prices and closed transactions, this March marks the second-highest in sales in the history of the RE/MAX National Housing Report,” said RE/MAX CEO Adam Contos. “It’s more important than ever to work with an experienced RE/MAX agent who is invested and involved in their community. They are dialed into the nuances of a neighborhood, making your home search or sale easier and quicker.”

The number of homes for sale in March 2018 was down -0.5 percent from February 2018, and down -14.7 percent from March 2017. Based on the rate of home sales in March, the Month’s Supply of Inventory decreased to 2.5 from February 2018 at 3.1, as well as decreased compared to March 2017 at 2.7. A 6.0-month’s supply indicates a market balanced equally between buyers and sellers. In March 2018, all 54 metro areas surveyed reported a month’s supply less than 6.0, which is typically considered a balanced market. The markets with the lowest Month’s Supply of Inventory continue to be in the west with San Francisco, Calif. at 0.7; Denver, Colo. and Seattle, Wash. both at 0.9; and Boise, Idaho and Omaha, Neb. at 1.1.

About the author