Advertisement

Home Values Remain Lower in Historically Redlined Areas

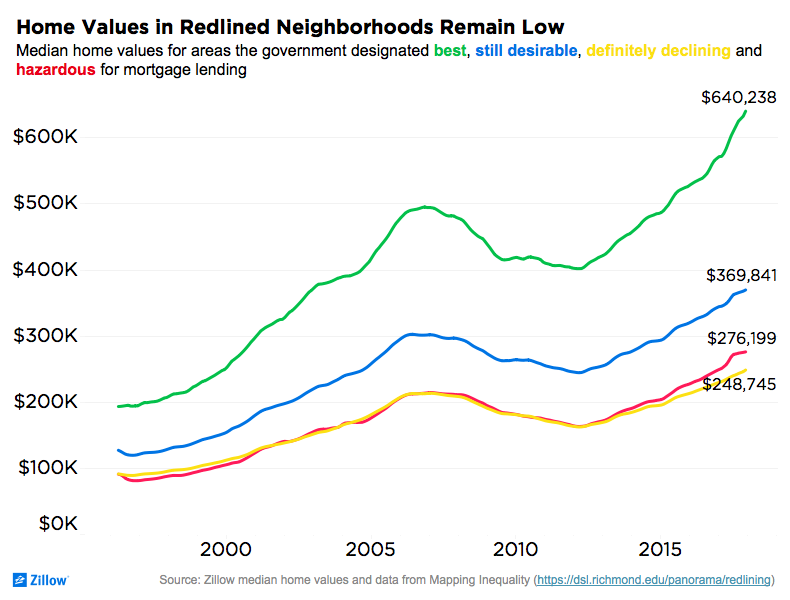

In the half-century since the passage of the Fair Housing Act, the residue of discrimination can still be felt in areas that were once designated for redlining by the long-defunct federal Home Owners’ Loan Corp. (HOLC).

According to a new data analysis by Zillow, the median value of a home in areas that were redlined is $276,199, which is roughly $50,000 below the $324,489 median value of homes in the surrounding areas. In some formerly redlined areas, the disparity is more pronounced: homes in Atlanta communities that were once marked as "hazardous" by the HOLC are worth $193,866, compared with $428,813 for the rest of the region, while home in the old redlined sections of Tampa are valued at $219,991, compared to $482,141 for homes in the surrounding areas.

The HOLC was created by President Franklin D. Roosevelt in 1933 in response to the housing crisis fueled by the Great Depression. The agency created appraisal sheets and so-called “Residential Security Maps” that marked off areas deemed "hazardous" for mortgage origination—and many of these areas were predominantly black communities. The practice, which became known as redlining due to the crimson borders drawn on the HOLC maps, continued after the agency was shuttered in 1954.

"The lasting impact of redlining is a striking example of how the kind of discrimination, financial and racial, codified nearly a century ago continues to affect homeowners and whole communities today," said Zillow Chief Economist Svenja Gudell. "Redlining and other forms of systemic discrimination, from Jim Crow laws to racial covenants, contributed to a serious divide in homeownership rates between whites and other groups that has had devastating consequences for both the financial wealth and social health of non-white Americans."

Gudell noted there were a few exceptions to this rule—most notably in Boston, where the average home value in a formerly redlined area was about $95,000 higher than the surrounding communities. "With the renewed popularity of inner cities in particular in recent years, some formerly redlined areas are experiencing a renaissance of sorts, but even in these areas ‘success’ is relative," she added. "Gentrification and eminent domain, for example, have both re-shaped cities and often displaced long-time residents, many of them people of color. Progress toward closing these gaps and righting history's wrongs has been slow, and clearly there's a lot of work left to be done."

About the author