Advertisement

New Reports Detail Challenges Facing Renters

Two newly released data reports are offering a difficult picture of today’s rental home sector.

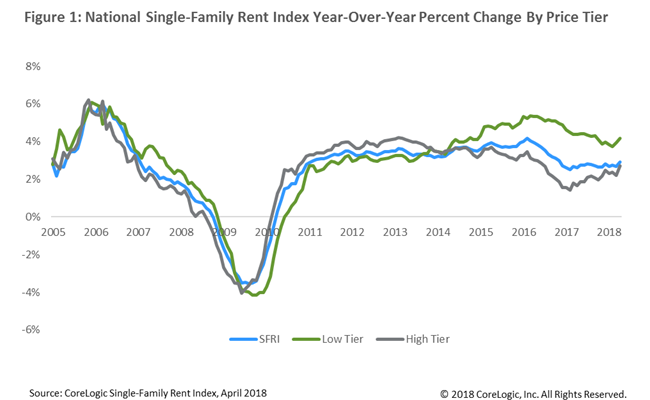

CoreLogic’s latest Single-Family Rent Index tracking single-family rent price changes nationally and among 20 metropolitan areas found a national rent increase of 2.9 percent in April, up from the 2.6 percent level one year earlier. High-end rentals, defined as properties with rent prices greater than 125 percent of a region's median rent, recorded rent increases of 2.7 percent year-over-year in April, up from an annualized gain of 1.6 percent in April 2017. Rent prices among low-end rentals, defined as properties with rent prices less than 75 percent of the regional median, increased 4.2 percent in April, down from a gain of 4.4 percent in April 2017. Rent prices for both the high- and low-tiers were above the increases of 2.2 percent and 3.9 percent in March respectively.

Among the 20 metro areas tracked by CoreLogic, Las Vegas had the highest year-over-year increase in single-family rents in April at 5.9 percent, followed by Phoenix with a 5.5 percent increase and Orlando with a 5.3 percent increase. For the sixth consecutive month, Honolulu was the only metro with decreasing rent prices, dropping 0.3 percent year-over-year in April.

"Rent prices increased significantly across the country in April, with the southwest region showing the highest growth rates," said Molly Boesel, Principal Economist at CoreLogic. "National employment growth has remained steady in 2018, which could be a driver of continued rent increases."

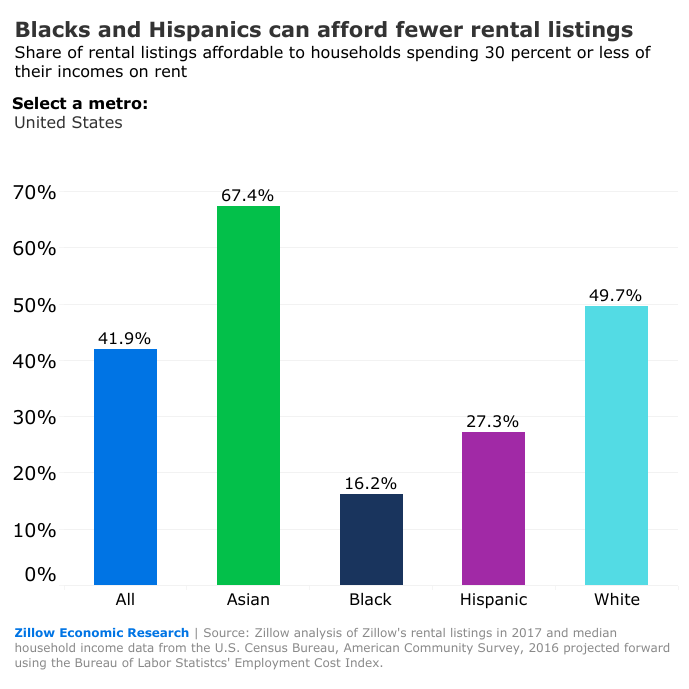

Separately, Zillow reported that African-Americans renters could only afford less than one-third of the rentals during 2017 than white or Asian-American renters. Last year, a renter making the median black household income of $39,647 could afford 16.2 percent of the available rentals on Zillow without putting more than 30 percent of their pre-tax income toward housing costs. If they spent 45 percent of their income on rent, they could afford 42 percent of the listed rentals.

In comparison, renters earning the median Asian-American household income of $83,007 could afford 67.4 percent of rentals while spending 30 percent of their income on housing, while white renters with a median income of $64,944 could afford 49.7 percent of listed rentals. Renters earning the median Hispanic household income $48,210 could afford 27.3 percent of rentals last year.

"Perhaps more so than any other factor, income determines where and how we live in the United States today. Income disparities across racial and ethnic groups in the United States have remained stubbornly persistent, and as a result, Black and Hispanic families encounter far fewer affordable rental options than white and Asian families," said Zillow Senior Economist Aaron Terrazas. "With fewer affordable options, these households are likely to have to make sacrifices elsewhere, whether that means putting a higher share of their income toward rent and cutting back on saving, cutting costs elsewhere in their budgets, moving further away or living with more people. The desire to own a home is similar across all races, but the difference in homeownership rates between races is wide—a lasting legacy of the historical income gap."

About the author