Advertisement

Mortgage Rates Remain Flat

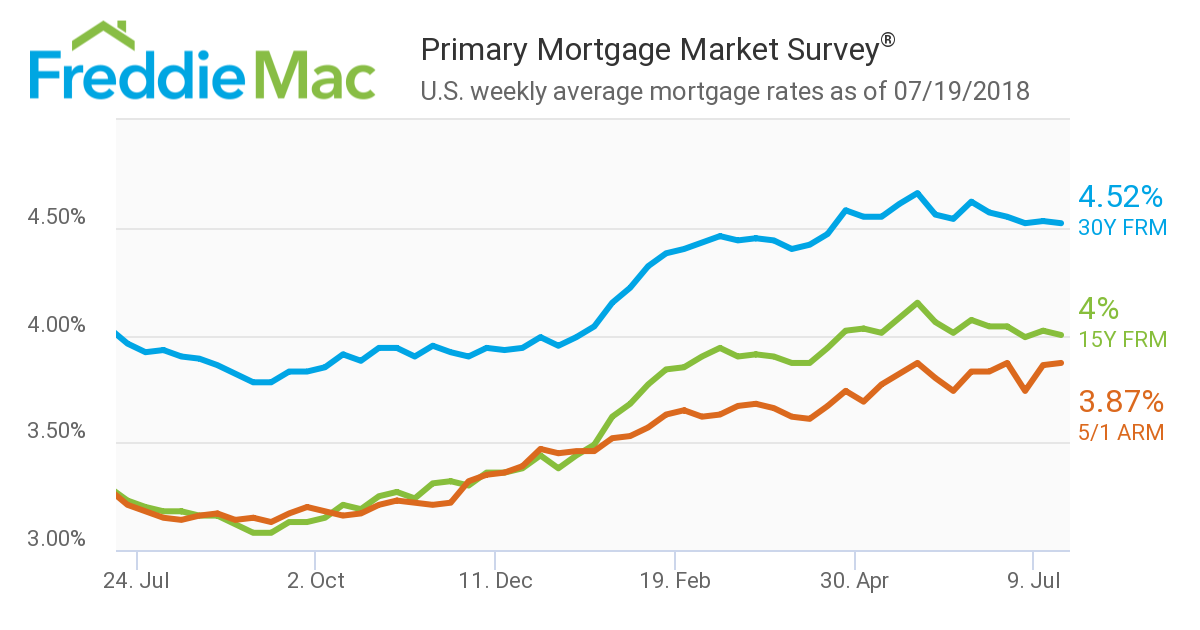

Mortgage rate movement was mostly desultory in the latest Primary Mortgage Market Survey (PMMS) from Freddie Mac.

The 30-year fixed-rate mortgage (FRM) averaged 4.52 percent for the week ending July 19, down from last week when it averaged 4.53 percent. The 15-year FRM this week averaged four percent, down from last week when it averaged 4.02 percent. And the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.87 percent this week, up from last week when it averaged 3.86 percent.

“Manufacturing output and consumer spending showed improvements, but construction activity was a disappointment,” said Sam Khater, Freddie Mac’s Chief Economist. “This meant there was no driving force to move mortgage rates in any meaningful way, which has been the theme in the last two months. That’s good news for price sensitive home shoppers, given that this stability in borrowing costs allows them a little extra time to find the right home. Unfortunately, don’t expect much relief from the tight inventory conditions plaguing many markets. As seen again last month, new home construction is not picking up to meet demand, and as a result, home prices are still rising at double the pace of income growth.”

About the author