Advertisement

Mortgage Apps See 7.1 Percent Weekly Dip

Mortgage applications decreased 7.1 percent from one week earlier, according to the latest Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending Oct. 12, 2018.

The Market Composite Index, a measure of mortgage loan application volume, decreased 7.1 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased seven percent compared with the previous week. The Refinance Index decreased nine percent from the previous week. The seasonally adjusted Purchase Index decreased six percent from one week earlier. The unadjusted Purchase Index decreased six percent compared with the previous week and was two percent higher than the same week one year ago.

The refinance share of mortgage activity decreased to 38.1 percent of total applications from 39.0 percent the previous week. The adjustable-rate mortgage (ARM) share of activity decreased to 7.1 percent of total applications.

The FHA share of total applications decreased to 10.4 percent from 10.5 percent the week prior. The VA share of total applications increased to 10.4 percent from 10.0 percent the week prior. The USDA share of total applications remained unchanged at 0.8 percent from the week prior.

The FHA share of total applications decreased to 10.4 percent from 10.5 percent the week prior. The VA share of total applications increased to 10.4 percent from 10.0 percent the week prior. The USDA share of total applications remained unchanged at 0.8 percent from the week prior.

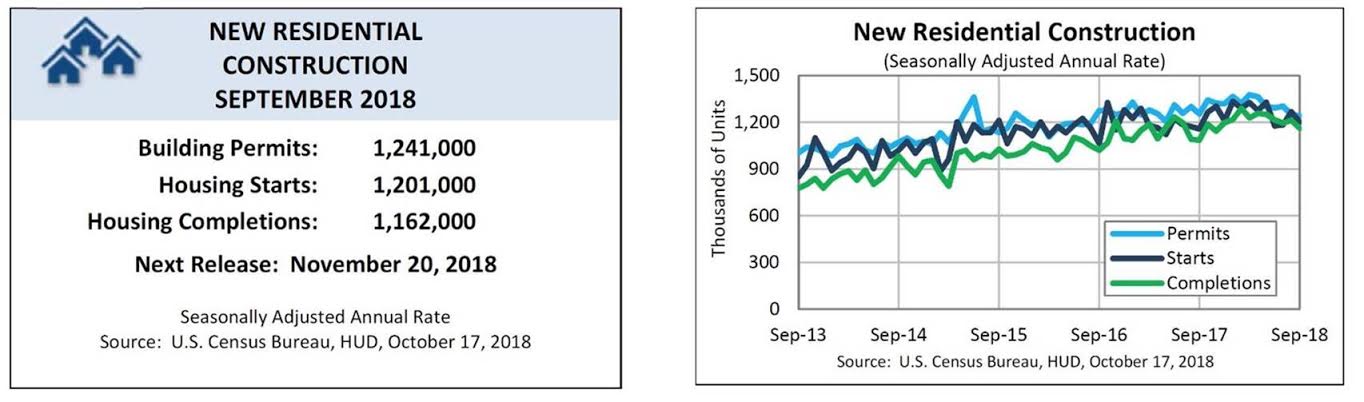

Meanwhile, the U.S. Department of Housing & Urban Development (HUD) and the U.S. Census Bureau jointly announced the following new residential construction statistics for September 2018, finding that privately owned housing starts in September were at a seasonally-adjusted annual rate of 1,201,000, 5.3 percent below the revised August estimate of 1,268,000, but 3.7 percent September of 2017’s rate of 1,158,000. Single-family housing starts in September were at a rate of 871,000, 0.9 percent below the revised August figure of 879,000. The September rate for units in buildings with five units or more was 324,000.

Privately-owned housing completions in September were at a seasonally adjusted annual rate of 1,162,000, 4.1 percent below the revised August estimate of 1,212,000, but seven percent above the September 2017 rate of 1,086,000. Single-family housing completions in September were at a rate of 844,000, 8.7 percent below the revised August rate of 924,000. The September rate for units in buildings with five units or more was 312,000.

About the author