Advertisement

Mortgage Apps Down, Home Value Perceptions Stable

Fewer homebuyers were searching for home loans while fewer homeowners were questioning the veracity of their home values, according to two new data reports.

The Mortgage Bankers Association’s (MBA) report on home loan applications for the week ending Oct. 5 found the Market Composite Index down by 1.7 percent on a seasonally adjusted basis from one week earlier, while the unadjusted index was down by two percent. Both the seasonally adjusted and unadjusted Purchase Index decreased one percent from one week, with the unadjusted index two percent higher than the same week one year ago. The Refinance Index decreased three percent from the previous week and the refinance share of mortgage activity decreased to 39 percent of total applications from 39.4 percent the previous week.

Among the federal programs, the FHA share of total applications increased to 10.5 percent from 10.2 percent the week prior while the VA share of total applications remained unchanged at 10 percent and the USDA share of total applications increased to 0.8 percent from 0.7 percent.

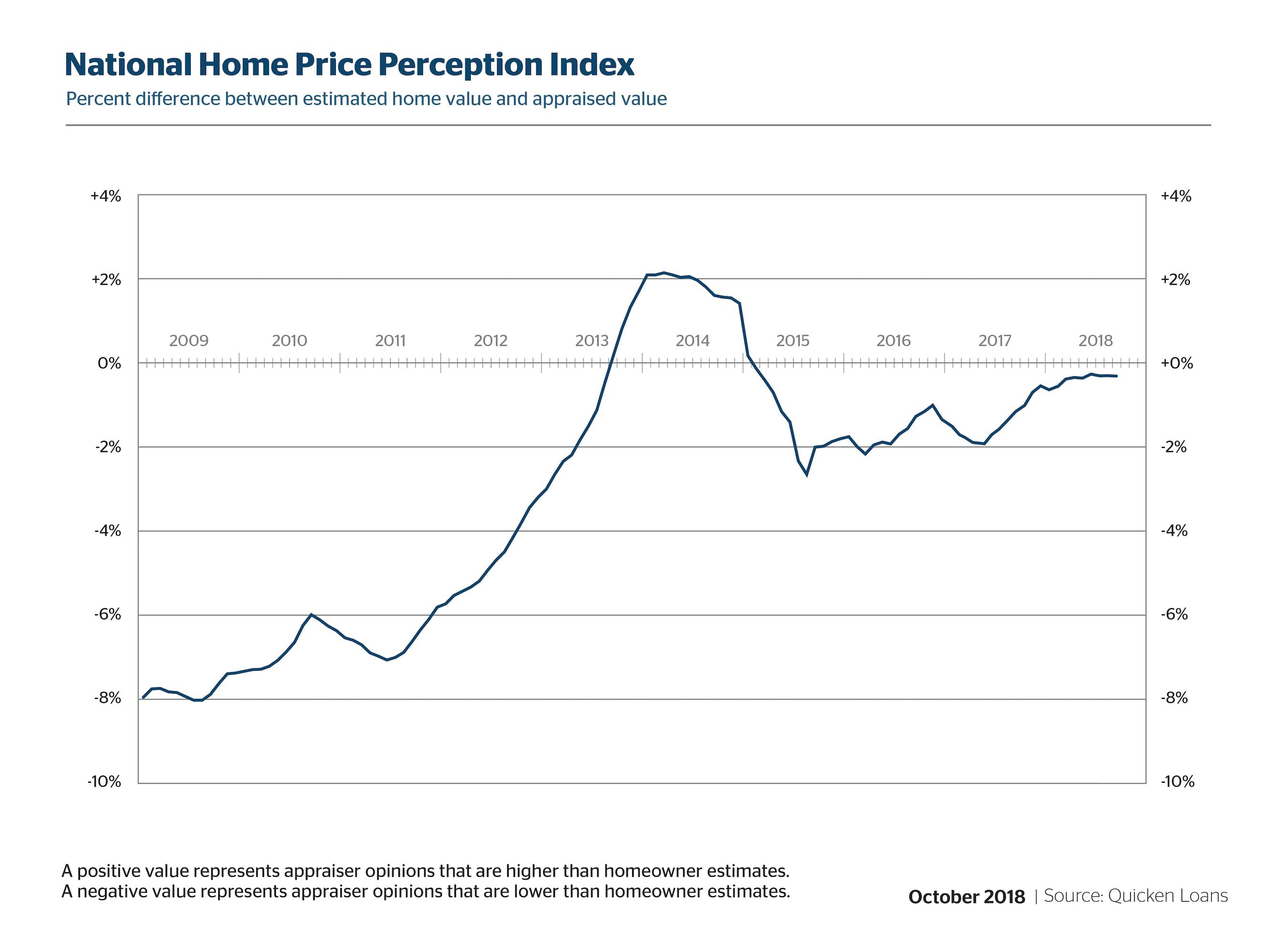

Separately, Quicken Loans reported that average appraisal in September was only 0.29 percent less than what owners expected, according to its latest Home Price Perception Index. This represented scant upward movement from the 0.28 percent level in August; one year ago, appraiser opinions were an average of 1.14 percent lower than homeowner expectations.

Quicken Loans also reported that its Home Value Index showed the average appraisal value rose 0.35 percent since the prior month, less than half of the growth rate from August. The annual increases in value was more robust, with 5.69 percent year-over-year jump in September compared to a 5.79 increase in August.

"A wide gap between the estimated home value and the appraised value can cause a mortgage to be reworked, or in some cases, scrapped altogether," said Bill Banfield, Quicken Loans’ Executive Vice President of Capital Markets. "All the more reason for homeowners to be realistic when their mortgage banker asks them what they think their home is worth when they start the financing process."

About the author