Advertisement

Volcker Views U.S. as a ‘Hell of a Mess in Every Direction’

Former Federal Reserve Chairman Paul Volcker offered a harsh denunciation on the state of the nation, insisting that “we’re in a hell of a mess in every direction.”

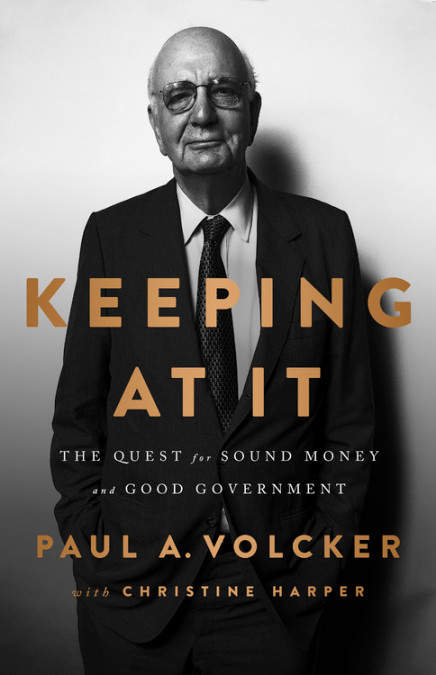

In a New York Times interview published ahead of the Oct. 30 release of his autobiography “Keeping at It: The Quest for Sound Money and Good Government,” Volcker claimed that the foundations of the federal government are no longer viewed with admiration.

“Respect for government, respect for the Supreme Court, respect for the president, it’s all gone,” he said. “Even respect for the Federal Reserve. And it’s really bad. At least the military still has all the respect. But I don’t know, how can you run a democracy when nobody believes in the leadership of the country?”

In his book, Volcker recalled an effort by the Reagan Administration to prevent the Federal Reserve from raising rates. He noted a 1984 meeting in the library next to the Oval Office where President Reagan sat silently while Chief of Staff James Baker told him, “The President is ordering you not to raise interest rates before the election.”

“I was stunned,” Volcker stated, noting that he was not planning a rate hike at the time. “I later surmised that the library location had been chosen because, unlike the Oval Office, it probably lacked a taping system.”

Looking at the financial services industry through a post-Dodd-Frank spectrum, Volcker said the nation’s banks were “in a stronger position than they were, but the honest answer is I don’t know how much they’re manipulating.” He also opposed the notion of deregulating the financial services companies.

“Everybody talks about monetary policy,” he said, “but the lesson of all this is we need better, stronger supervisory powers.”

About the author