Advertisement

Mortgage Applications and Rates Down

There was relative scant movement with mortgage application activity for the week ending Nov. 16, according to new data from the Mortgage Bankers Association (MBA).

The Market Composite Index slid by 0.1 percent on a seasonally adjusted basis from one week earlier, while the unadjusted index took a three percent downturn. The seasonally adjusted Purchase Index increased three percent from one week earlier but the unadjusted index was one percent lower from the previous week and was five percent lower than the same week one year ago. The Refinance Index fell by five percent from the previous week to its lowest level since December 2000 as the refinance share of mortgage activity decreased to 38.5 percent of total applications from 39.4 percent the previous week.

Among the federal programs, the FHA share of total applications increased to 10.7 percent from 10.6 percent the week prior and the VA share of total applications increased to 10.6 percent from 10.1 percent, while the USDA share of total applications remained unchanged at 0.7 percent.

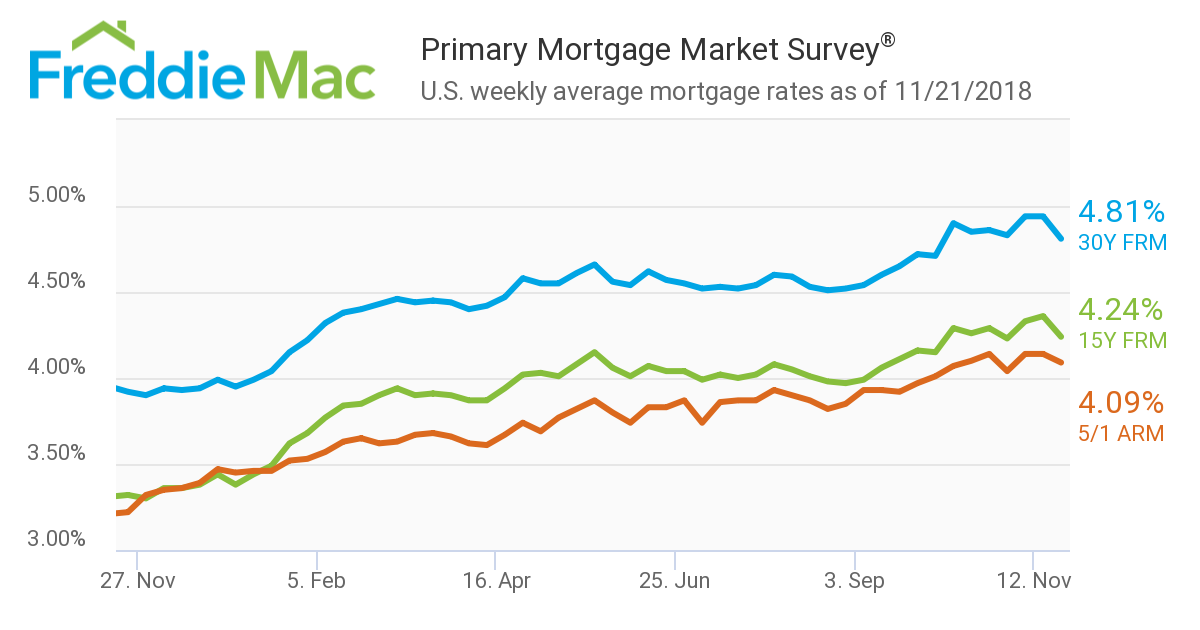

Separately, Freddie Mac released the results of its Primary Mortgage Market Survey (PMMS) one day early—the usual Thursday data report coincided with Thanksgiving, hence the switch.

The survey found the 30-year fixed-rate mortgage (FRM) averaged 4.81 percent for the week ending Nov. 21, down from last week when it averaged 4.94. The 15-year FRM this week averaged 4.24 percent, down from last week when it averaged 4.36 percent. And the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 4.09 percent, down from last week when it averaged 4.14 percent.

“The downward spiral in oil prices and a volatile equities market caused mortgage rates to decline 13 basis points to 4.81 percent, the largest weekly drop since January 2015,” said Sam Khater, Freddie Mac’s Chief Economist. “Mortgage rates are the lowest since early October and the dip offers a window of opportunity for would be buyers that have been on the fence waiting for a drop in mortgage rates.”

About the author