Advertisement

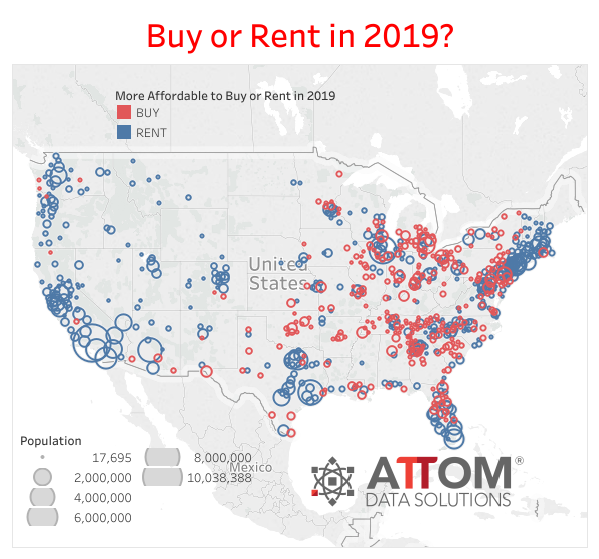

Renting Is More Affordable Than Buying in 59 Percent of Housing Markets

A new report from ATTOM Data Solutions has concluded it is less expensive to rent a three-bedroom property in 59 percent of the nation’s housing markets than it is to purchase the property.

The new report finds renting a home is more affordable in 442 of the 755 counties analyzed by ATTOM. Renting is more affordable than buying a home in the nation’s 18 most populated counties and in 37 of the 40 counties with a population of one million or more. ATTOM also determined that average weekly wages rose faster than average fair market rents in 361 of the 755 counties analyzed in the report, or 48 percent, while home prices rose faster than wages in 601 of the 775 counties, or 80 percent of markets. Median home prices rose faster than average fair market rents in 531 of the 755 counties, or 70 percent, studied for the new report.

“With rental affordability outpacing home affordability in the majority of U.S. housing markets, and home prices rising faster than rental rates, the American dream of owning a home, may be just that—a dream,” said Jennifer von Pohlmann, Director of Content and PR at ATTOM Data Solutions. “With home price appreciation increasing annually at an average of 6.7 percent in those counties analyzed for this report and rental rates increasing an average of 3.5 percent, coupled with the fact that home prices are outpacing wages in 80 percent of the counties, renting a home is clearly becoming the more attractive option in this volatile housing market.”

About the author