Advertisement

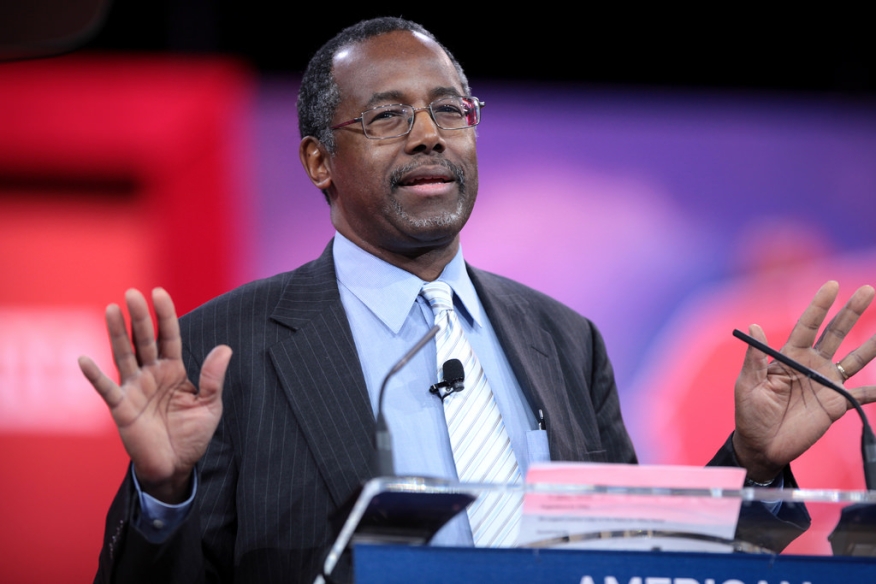

HUD’s Carson Berates Democrats on Obstructing Nominees

Housing and Urban Development Secretary Ben Carson took aim at Capitol Hill Democrats for blocking nominations of the Department’s nominees.

In an op-ed column published in the Washington Examiner, Carson complained about the “congressional procedural tactics to delay nominations for Senate-confirmed positions.” Carson noted that the “games employed by one side of the aisle to deny the other side its proposals has the deleterious effect of hurting the general public.”

Among the nominations that Carson lamented as being blocked were assistant secretary for Public and Indian Housing and assistant secretary for Policy Development and Research.

“At HUD, we need more support and funding for the crucial modernization of our systems, as our programs affect millions of citizens,” he wrote. “Unfortunately, conversations and actions required for enhancing these systems remain at a standstill due to antagonistic behavior in Congress. It must be remembered that those in Congress have a responsibility to work to overcome partisan gridlock for the sake of the public interest.”

About the author